425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on November 15, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2023

Graphite Bio, Inc.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 001-40532 | 84-4867570 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 611 Gateway Boulevard Suite 120 South San Francisco, California |

94080 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrants Telephone Number, Including Area Code: 650 484-0886

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange on which registered |

||

| Common Stock | GRPH | The NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

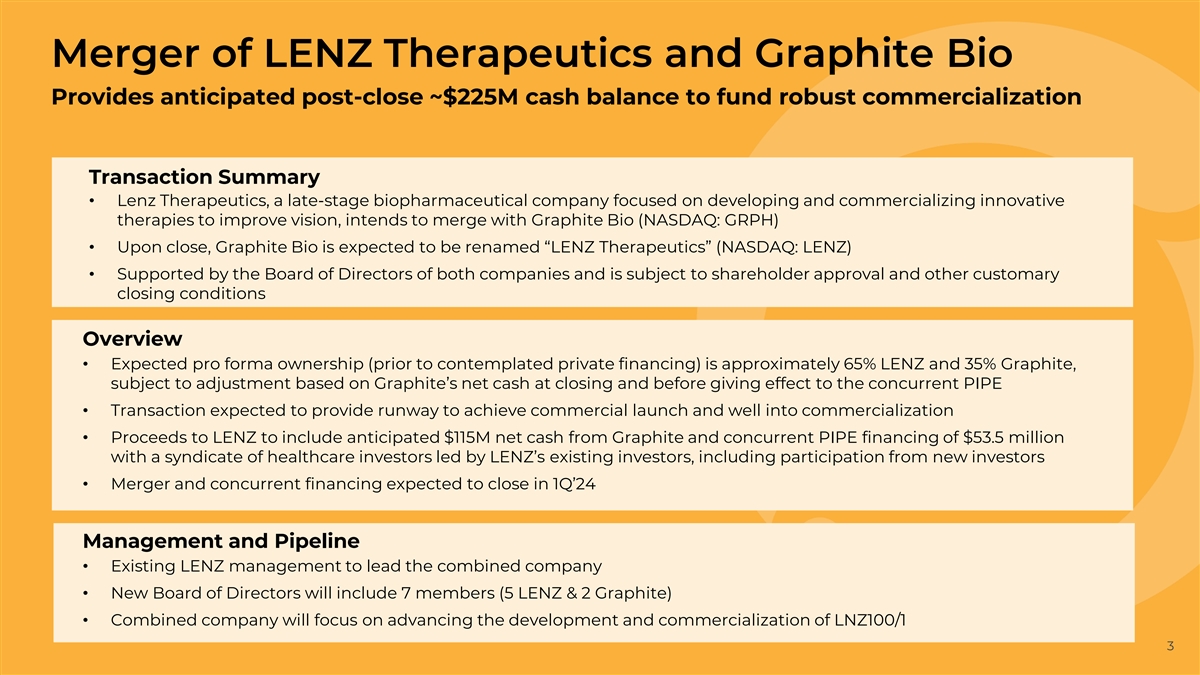

Merger Agreement

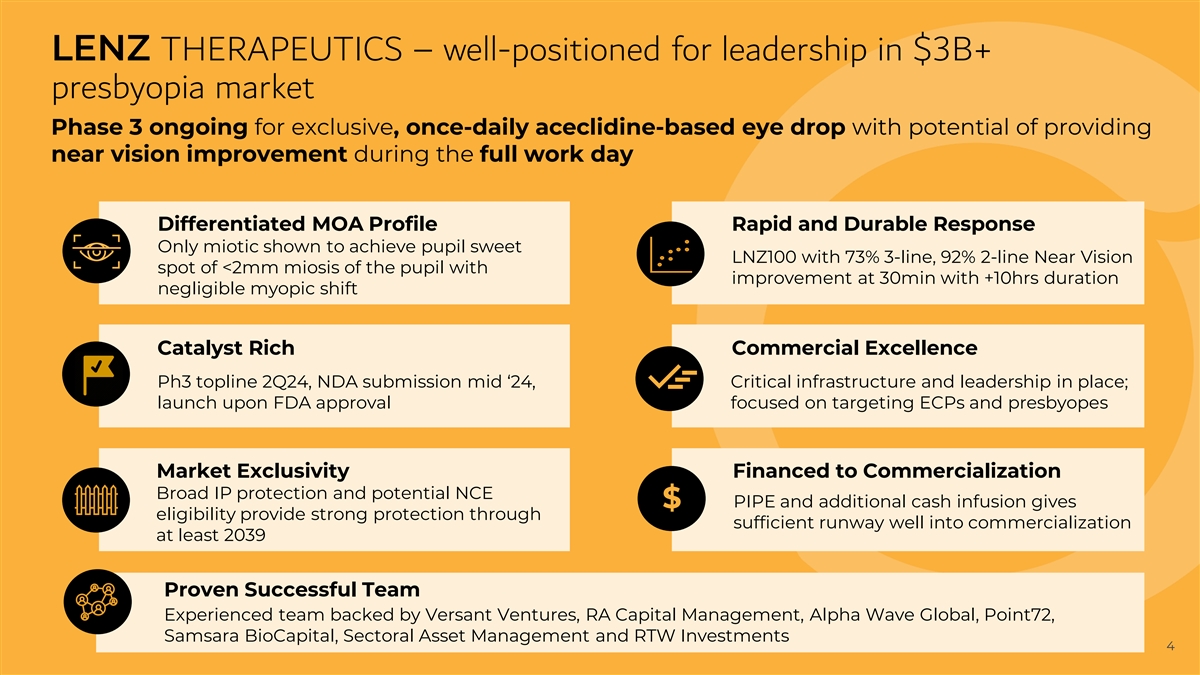

On November 14, 2023, Graphite Bio, Inc., a Delaware corporation (Graphite) entered into an Agreement and Plan of Merger (the Merger Agreement) by and between Graphite, Generate Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Graphite (Merger Sub), and Lenz Therapeutics, Inc., a Delaware corporation (LENZ), pursuant to which, and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, Merger Sub will merge with and into LENZ (the Merger), with LENZ continuing as a wholly owned subsidiary of Graphite and the surviving corporation of the merger. The Merger is intended to qualify for federal income tax purposes as a tax-free reorganization.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the Effective Time), (a) each then-outstanding share of LENZs common stock, par value $0.001 per share (LENZ Common Stock) will be converted into the right to receive a number of shares of Graphites common stock, par value $0.00001 per share (Graphite Common Stock), based on a ratio calculated in accordance with the Merger Agreement (the Exchange Ratio) and (b) each then-outstanding share of LENZs preferred stock, par value $0.001 per share (LENZ Preferred Stock) will be converted into the right to receive a number of shares of Graphite Common Stock equal to the Exchange Ratio multiplied by the aggregate number of LENZ Common Stock into which each share of LENZ Preferred Stock is then convertible, (c) each then-outstanding option to purchase LENZ Common Stock will be assumed by Graphite, subject to adjustment as set forth in the Merger Agreement and (d) each then-outstanding warrant to purchase shares of LENZ Common Stock or LENZ Preferred Stock will be converted into a warrant to purchase shares of Graphite Common Stock, subject to adjustment as set forth in the Merger Agreement.

Under the Exchange Ratio formula in the Merger Agreement, upon the closing of the Merger (the Closing), on a pro forma basis and based upon the number of shares of Graphite Common Stock expected to be issued in the Merger, pre-Merger LENZ stockholders will own approximately 65% of the combined company, pre-Merger Graphite stockholders will own approximately 35% of the combined company on a fully-diluted basis (prior to giving effect to the Concurrent PIPE Investment described below and excluding any shares reserved for future grants under the 2023 Equity Incentive Plan and the 2023 ESPP, each as defined in the Merger Agreement). Under certain circumstances further described in the Merger Agreement, the ownership percentages may be adjusted upward or downward based on the level of Graphites net cash at the Closing.

The Exchange Ratio assumes (i) a valuation for Graphite of $126.5 million, which is subject to adjustment to the extent that Graphites net cash at Closing is less or greater than $175 million by $1 million, as further described in the Merger Agreement, and before giving effect to the Cash Dividend (as described below), and (ii) a valuation for LENZ of $231.6 million. The Exchange Ratio is also based on the relative capitalization of each of Graphite and LENZ, for which, for the purposes of calculating the Exchange Ratio, the shares of Graphite Common Stock underlying Graphite stock options outstanding immediately prior to the Effective Time with an exercise price per share of less than or equal to $3.00 will be deemed outstanding, and all shares of LENZ Common Stock underlying outstanding LENZ stock options, warrants, and other derivative securities will be deemed outstanding.

The unexercised and outstanding Graphite stock options with an exercise price per share of equal to or greater than $3.00 (prior to giving effect to the Cash Dividend and Nasdaq Reverse Stock Split (as defined in the Merger Agreement)), will accelerate in full as of immediately prior to the Effective Time and each such stock option not exercised as of immediately prior to the Effective Time shall be cancelled at the Effective Time for no consideration. All Graphite stock options with an exercise price per share of less than $3.00 will continue to be subject to the same terms and conditions after the Effective Time as were applicable to such stock option as of immediately prior to the Effective Time.

In addition, in connection with the Closing, Graphite expects to declare a cash dividend to the pre-Merger Graphite stockholders of $60 million in the aggregate (the Cash Dividend), provided such amount is subject to adjustment as set forth in the Merger Agreement.

In connection with the Merger, Graphite will seek the approval of its stockholders to, among other things, (a) issue the shares of Graphite Common Stock issuable in connection with the Merger and the Concurrent PIPE Investment described below pursuant to the rules of The Nasdaq Stock Market LLC (Nasdaq), (b) adopt the 2023 Equity Incentive Plan and the 2023 ESPP (as each is defined in the Merger Agreement), and (c) amend its amended and restated certificate of incorporation to change Graphites name to LENZ Therapeutics, Inc. and effect a reverse stock split of Graphite Common Stock, at a reverse stock split ratio to be mutually agreed to by Graphite and LENZ (the Graphite Voting Proposals).

Each of Graphite and LENZ has agreed to customary representations, warranties and covenants in the Merger Agreement, including, among others, covenants relating to (1) obtaining the requisite approval of their respective stockholders, (2) non-solicitation of alternative acquisition proposals, (3) the conduct of their respective businesses during the period between the date of signing the Merger Agreement and the Closing, (4) Graphite using commercially reasonable efforts to maintain the existing listing of the Graphite

Common Stock on Nasdaq and cause the shares of Graphite Common Stock to be issued in connection with the Merger to be approved for listing on Nasdaq prior to the Closing and (5) Graphite filing with the U.S. Securities and Exchange Commission (the SEC) and causing to become effective a registration statement on Form S-4 to register the shares of Graphite Common Stock to be issued in connection with the Merger (the Registration Statement).

Consummation of the Merger is subject to certain closing conditions, including, among other things, (1) approval by Graphite stockholders of the Graphite Voting Proposals, (2) approval by the requisite LENZ stockholders of the adoption and approval of the Merger Agreement and the transactions contemplated thereby, (3) the waiting period under the U.S. Hart Scott-Rodino Antitrust Improvements Act of 1976, as amended, having expired or been terminated, (4) Nasdaqs approval of the listing of the shares of Graphite Common Stock to be issued in connection with the Merger, (5) the effectiveness of the Registration Statement, (6) an executed Subscription Agreement for the Concurrent PIPE Investment (or other Permitted Financing, as defined in the Merger Agreement) in full force and effect evidencing cash proceeds of not less than $50 million to be received by the combined company immediately prior to or following the Closing, (7) the filing of Graphites Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and (8) Graphites net cash at Closing, following deduction of the Cash Dividend, being no less than $115,000,000. Each partys obligation to consummate the Merger is also subject to other specified customary conditions, including regarding the accuracy of the representations and warranties of the other party, subject to the applicable materiality standard, and the performance in all material respects by the other party of its obligations under the Merger Agreement required to be performed on or prior to the date of the Closing.

The Merger Agreement contains certain termination rights of each of Graphite and LENZ. Upon termination of the Merger Agreement under specified circumstances, Graphite may be required to pay LENZ a termination fee of $7,500,000, and in certain other circumstances, LENZ may be required to pay Graphite a termination fee of $7,500,000.

At the Effective Time, the board of directors of Graphite is expected to consist of seven members, five of whom will be designated by LENZ and two of whom will be designated by Graphite.

Support Agreements and Lock-Up Agreements

Concurrently and in connection with the execution of the Merger Agreement, (i) certain stockholders of LENZ (solely in their respective capacities as LENZ stockholders) holding approximately 70% of the outstanding shares of LENZ capital stock have entered into support agreements with Graphite and LENZ to vote all of their shares of LENZ capital stock in favor of the adoption and approval of the Merger Agreement and the transactions contemplated thereby (the LENZ Support Agreements) and (ii) certain stockholders of Graphite holding approximately 52% of the outstanding shares of Graphite Common Stock have entered into support agreements with Graphite and LENZ to vote all of their shares of Graphite Common Stock in favor of the Graphite Stockholder Proposals; provided, that in the event of a Parent Board Adverse Recommendation Change (as defined in the Merger Agreement), then the aggregate number of Covered Shares (as defined in the Graphite Support Agreement) will automatically be reduced on a pro rata basis so that the Covered Shares shall collectively only constitute the greater of (a) 20% of the outstanding shares of Graphite Common Stock or (b) 30% of the votes cast in support of the Graphite Stockholder Proposals (the Graphite Support Agreements, and, together with the LENZ Support Agreements, the Support Agreements).

Concurrently and in connection with the execution of the Merger Agreement, certain executive officers, directors and stockholders of Graphite and LENZ have entered into lock-up agreements (the Lock-Up Agreements) pursuant to which, and subject to specified exceptions, they have agreed not to transfer their shares of Graphite Common Stock for the 90-day period following the Closing.

The preceding summaries of the Merger Agreement, the Support Agreements and the Lock-Up Agreements do not purport to be complete and are qualified in their entirety by reference to the Merger Agreement, the form of Graphite Support Agreement, the form of LENZ Support Agreement, and the form of Lock-Up Agreement, which are filed as Exhibits 2.1, 10.1, 10.2, and 10.3, respectively, to this Current Report on Form 8-K and which are incorporated herein by reference. The Merger Agreement has been attached as an exhibit to this Current Report on Form 8-K to provide investors and securityholders with information regarding its terms. It is not intended to provide any other factual information about Graphite or LENZ or to modify or supplement any factual disclosures about Graphite in its public reports filed with the SEC. The Merger Agreement includes representations, warranties and covenants of Graphite, LENZ, and Merger Sub made solely for the purpose of the Merger Agreement and solely for the benefit of the parties thereto in connection with the negotiated terms of the Merger Agreement. Investors should not rely on the representations, warranties and covenants in the Merger Agreement or any descriptions thereof as characterizations of the actual state of facts or conditions of Graphite, LENZ or any of their respective affiliates. Moreover, certain of those representations and warranties may not be accurate or complete as of any specified date, may be modified in important part by the underlying disclosure schedules which are not filed publicly, may be subject to a contractual standard of materiality different from those generally applicable to SEC filings or may have been used for purposes of allocating risk among the parties to the Merger Agreement, rather than establishing matters of fact.

Private Placement and Subscription Agreement

On November 14, 2023, Graphite entered into a Subscription Agreement (the Subscription Agreement) with certain existing LENZ stockholders and new investors (the PIPE Investors).

Pursuant to the Subscription Agreement, and subject to the terms and conditions of such agreements, Graphite agreed to sell, and the PIPE Investors agreed to purchase, shares of Graphite Common Stock for an aggregate purchase price of $53.5 million (collectively, the Concurrent PIPE Investment). The Subscription Agreement provides that the Concurrent PIPE Investment amount (i) must be a minimum of $50 million and (ii) may be increased to up to $125 million through additional subscriptions under the Subscription Agreement from additional PIPE Investors.

The Concurrent PIPE Investment is exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the Securities Act), and/or Regulation D promulgated thereunder, as a transaction by an issuer not involving a public offering. The PIPE Investors have acquired the securities for investment only and not with a view to or for sale in connection with any distribution thereof, and appropriate legends have been affixed to the securities issued in this transaction.

The foregoing summary of the Subscription Agreement does not purport to be complete and is qualified in its entirety by reference to the Subscription Agreement, which is filed as Exhibit 10.4 to this Current Report on Form 8-K and incorporated herein by reference.

Registration Rights Agreement

At the closing of the Concurrent PIPE Investment, in connection with the Subscription Agreement, Graphite has agreed to enter into a Registration Rights Agreement (the Registration Rights Agreement) with the PIPE Investors and certain other stockholders of Graphite and LENZ. Pursuant to the Registration Rights Agreement, Graphite will prepare and file a resale registration statement with the SEC within 10 calendar days following the closing of the Concurrent PIPE Investment. Graphite will use commercially reasonable efforts to cause this registration statement to be declared effective by the SEC within 60 calendar days of the closing of the Concurrent PIPE Investment (or within 90 calendar days if the SEC reviews the registration statement or by such deadline as otherwise provided in the Registration Rights Agreement based on certain conditions addressed therein).

Graphite will also agree to, among other things, indemnify the PIPE Investors, their officers, directors, members, employees and agents, successors and assigns under the registration statement from certain liabilities and pay all fees and expenses (excluding any legal fees of the selling holder(s), and any underwriting discounts and selling commissions) incidents to Graphites obligations under the Registration Rights Agreement.

The foregoing summary of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the form of Registration Rights Agreement, which is provided as Exhibit B to the Subscription Agreement, which is filed as Exhibit 10.4 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 3.02. | Unregistered Sales of Equity Securities. |

To the extent required by this Item, the information included in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

The shares to be issued by Graphite in the Concurrent PIPE Investment will be issued in private placements exempt from registration under Section 4(a)(2) of the Securities Act, and/or Regulation D promulgated thereunder, because the offer and sale of such securities does not involve a public offering as defined in Section 4(a)(2) of the Securities Act, and other applicable requirements were met.

| Item 5.01. | Changes in Control of Registrant. |

To the extent required by this Item, the information included in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

To the extent required by this Item, the information included in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 7.01. | Regulation FD Disclosure. |

On November 15, 2023, Graphite and LENZ issued a joint press release announcing the execution of the Merger Agreement and the Subscription Agreement. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference, except that the information contained on the websites referenced in the press release is not incorporated herein by reference.

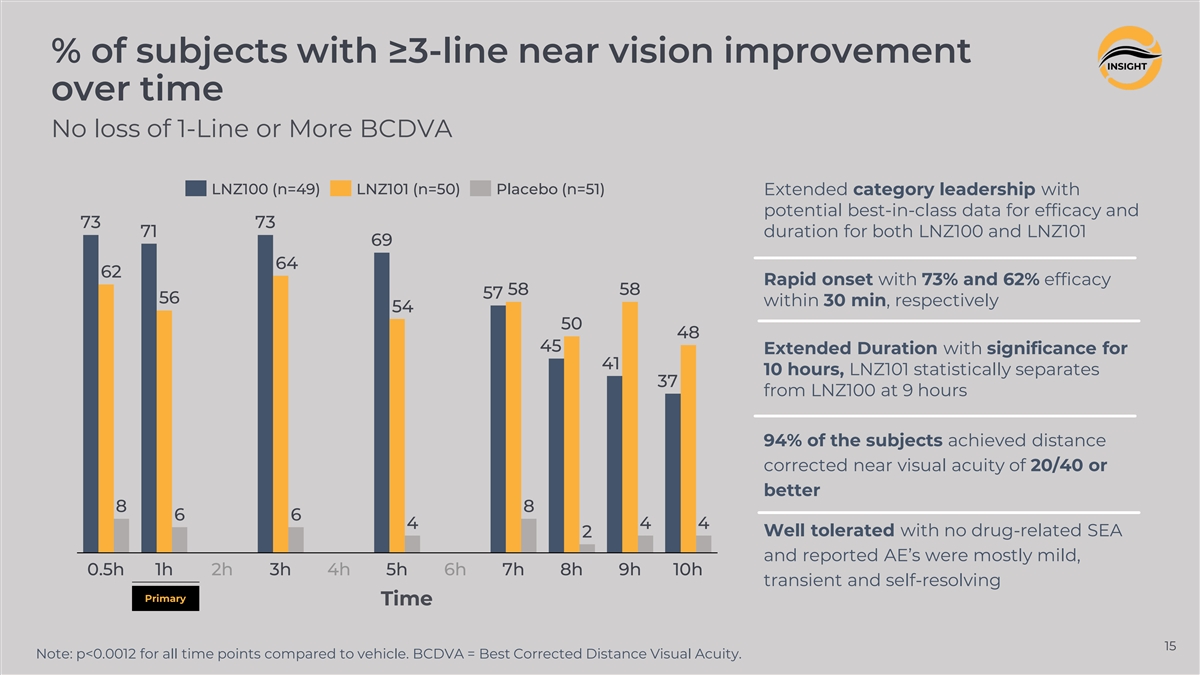

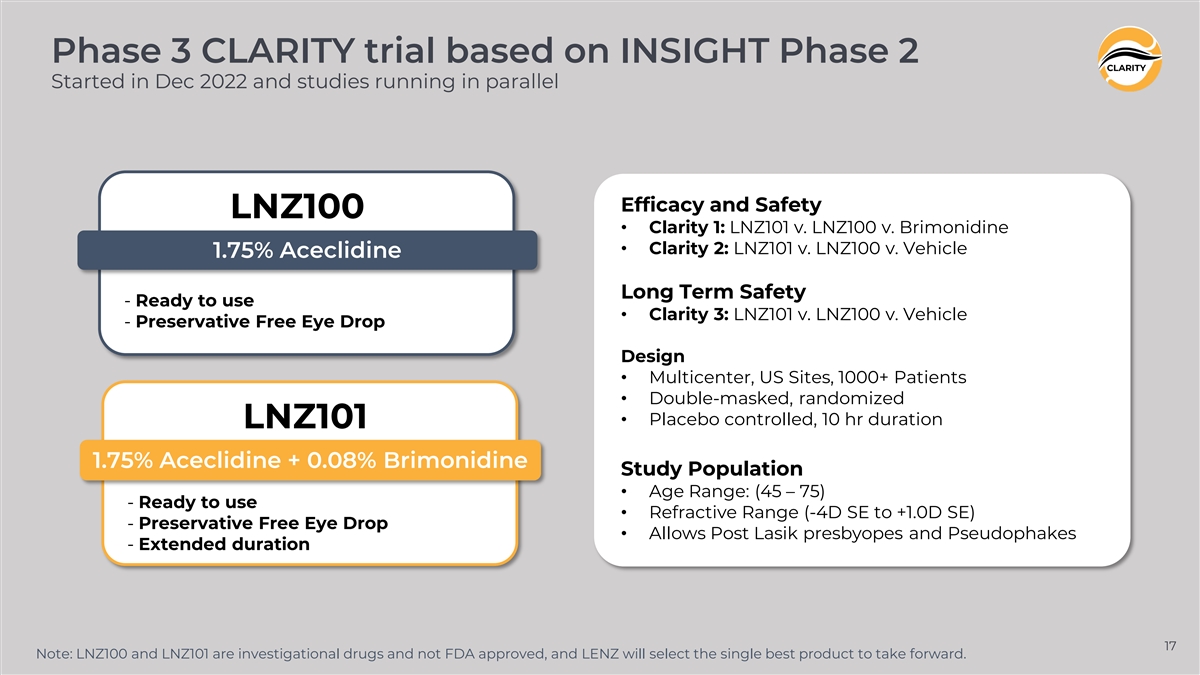

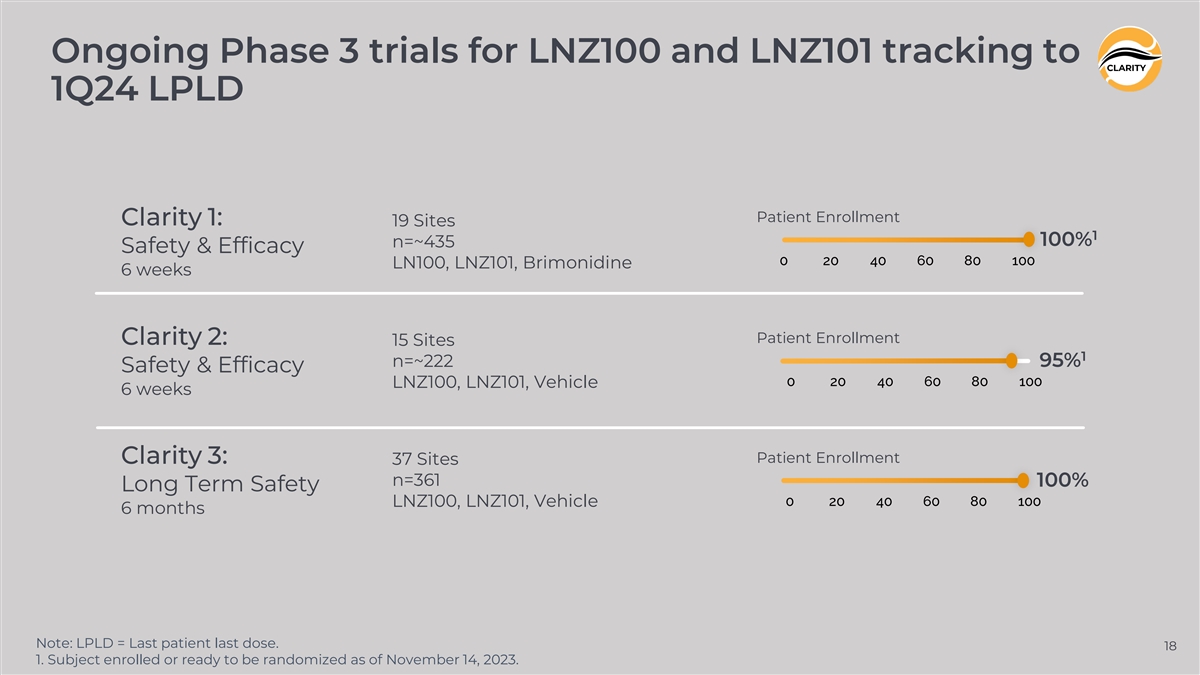

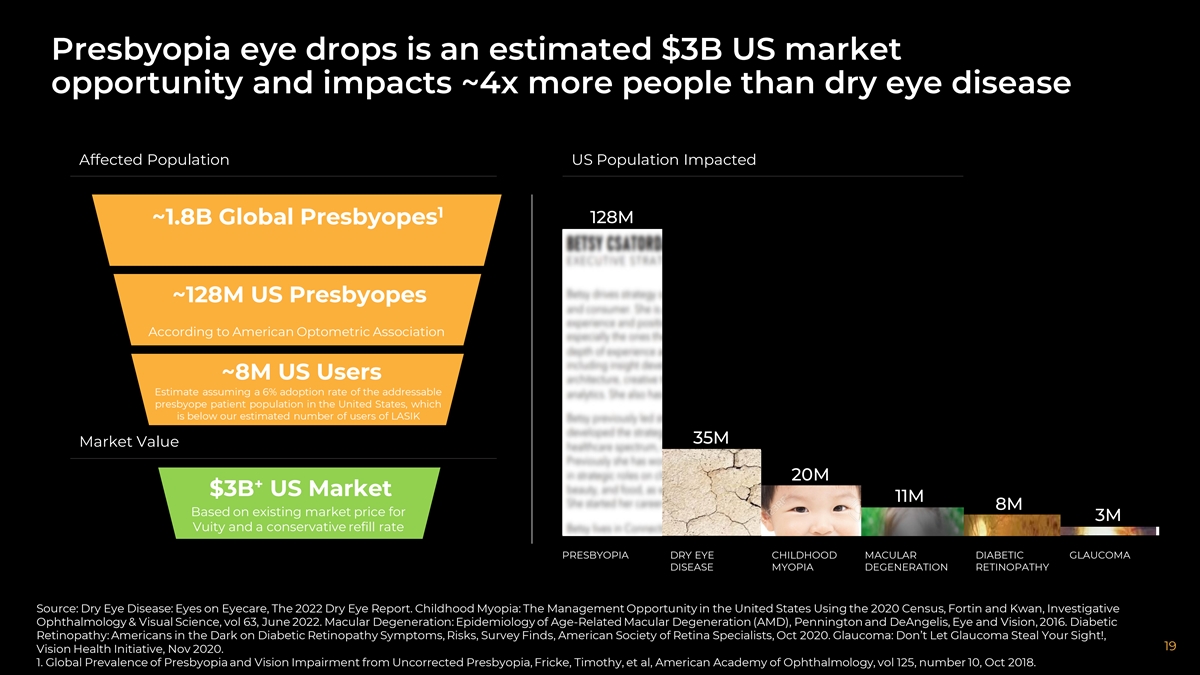

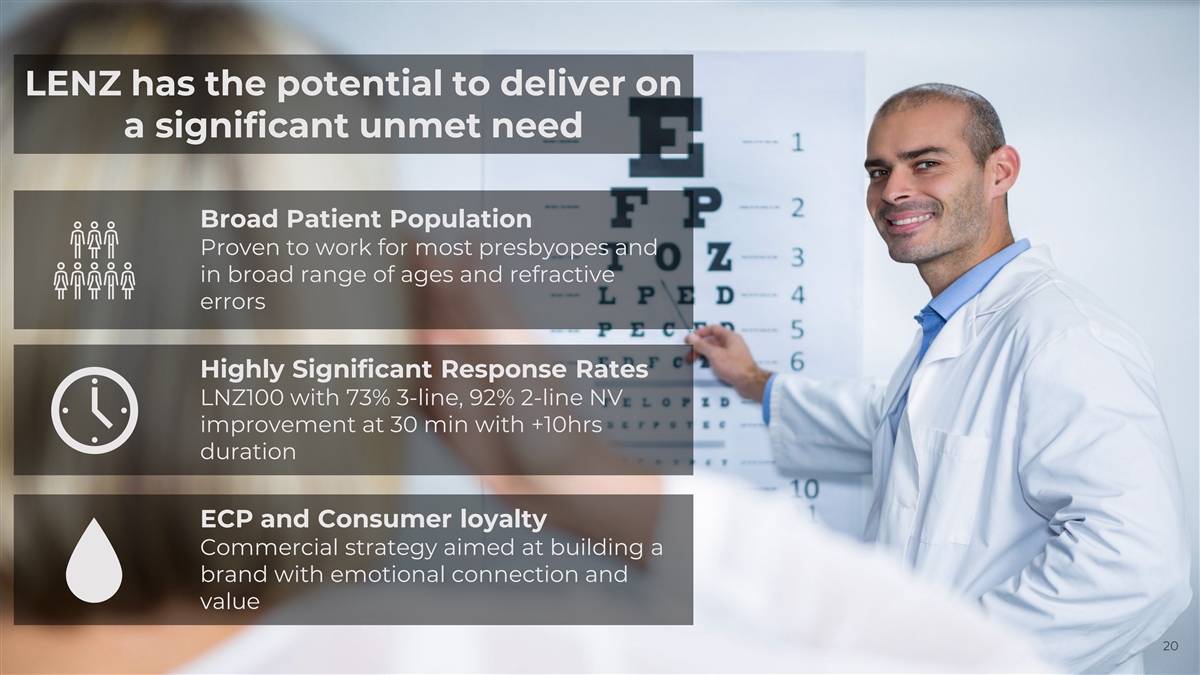

Furnished as Exhibit 99.2 hereto and incorporated herein by reference is the investor presentation that will be used by Graphite and LENZ in connection with the Merger, including during the webcast described below.

The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

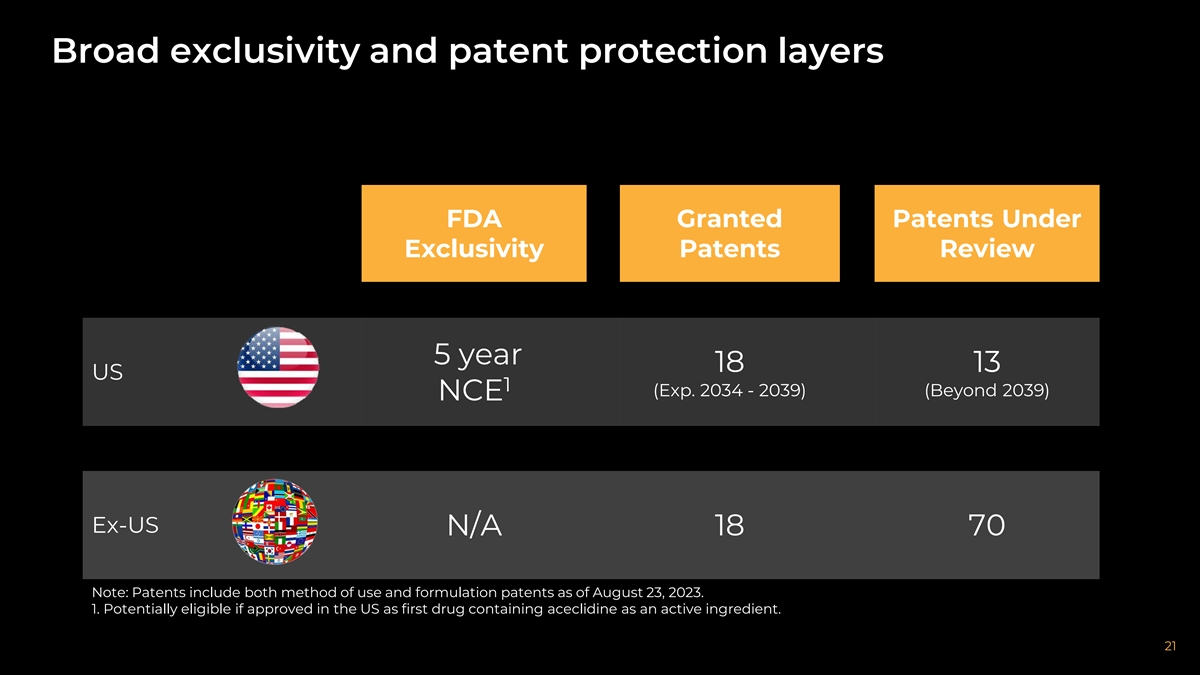

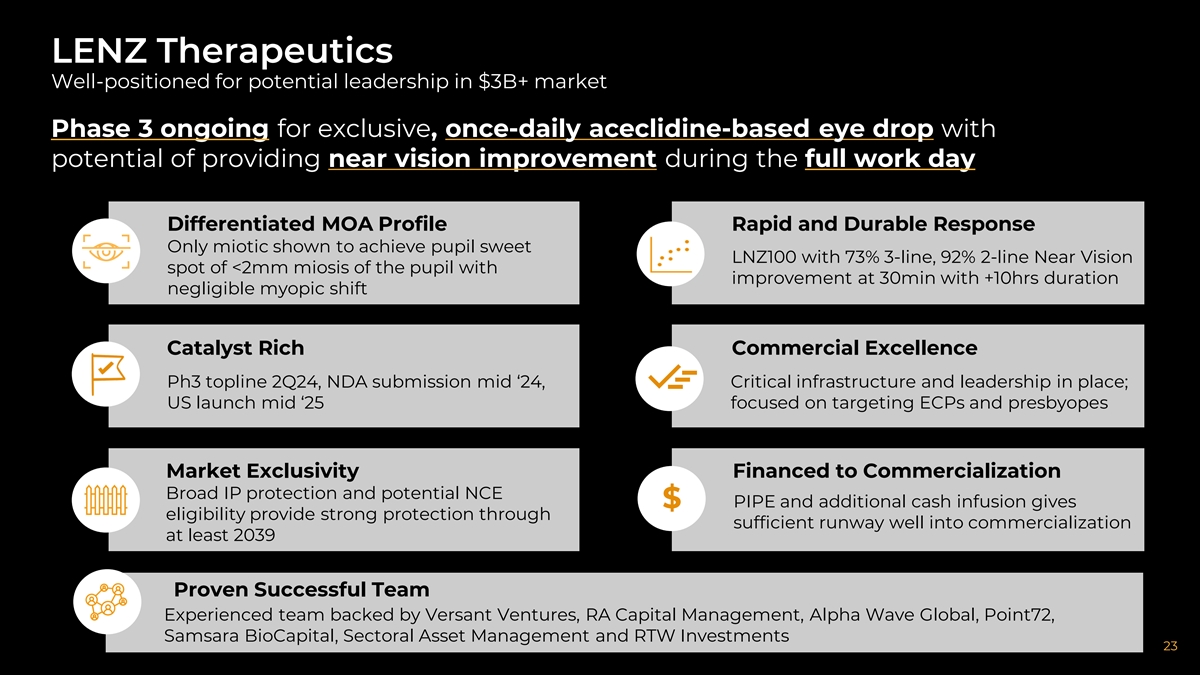

This communication contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, express or implied statements regarding the structure, timing and completion of the proposed merger by and between Graphite and LENZ; the combined companys listing on Nasdaq after the closing of the proposed Merger; expectations regarding the ownership structure of the combined company; the anticipated timing of the Closing; the expected executive officers and directors of the combined company; expectations regarding the structure, timing and completion of a concurrent private financing, including investment amounts from investors, timing of closing, expected proceeds and impact on ownership structure; each companys and the combined companys expected cash position at the Closing and cash runway of the combined company following the Merger and private financing; the future operations of the combined company, including commercialization activities, timing of launch, buildout of commercial infrastructure; the nature, strategy and focus of the combined company; the development and commercial potential and potential benefits of any product candidates of the combined company, including expectations around market exclusivity and IP protection; the location of the combined companys corporate headquarters; anticipated clinical drug development activities and related timelines, including the expected timing for announcement of data and other clinical results and potential submission of a New Drug Application for one or more product candidates; and other statements that are not historical fact. All statements other than statements of historical fact contained in this communication are forward-looking statements. These forward-looking statements are made as of the date they were first issued, and were based on the then-current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions of management. There can be no assurance that future developments affecting Graphite, LENZ, the Merger or the concurrent private financing will be those that have been anticipated.

Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Graphites control. Graphites actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to (i) the risk that the conditions to the Closing are not satisfied, including the failure to timely obtain stockholder approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Graphite and LENZ to consummate the proposed Merger; (iii) risks related to Graphites ability to manage its operating expenses and its expenses associated with the proposed Merger pending the Closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed Merger; (v) the risk that as a result of adjustments to the exchange ratio, Graphite stockholders and LENZ stockholders could own more or less of the combined company than is currently anticipated; (vi) risks related to the market price of Graphites common stock relative to the value suggested by the exchange ratio; (vii) unexpected costs, charges or expenses resulting from the transaction; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Merger; (ix) the uncertainties associated with LENZs product candidates, as well as risks associated with the clinical development and regulatory approval of product candidates, including potential delays in the completion of clinical trials; (x) risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance these product candidates; (xi) uncertainties in obtaining successful clinical results for product candidates and unexpected costs that may result therefrom; (xii) risks related to the failure to realize any value from product candidates being developed and anticipated to be developed in light of inherent risks and difficulties involved in successfully bringing product candidates to market; (xiii) risks associated with the possible failure to realize certain anticipated benefits of the proposed Merger, including with respect to future financial and operating results; (xiv) the risk that the private financing is not consummated upon the Closing; and (xv) the risk that Graphite stockholders receive more or less of the cash dividend than is currently anticipated, among others. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic filings with the SEC, including the factors

described in the section titled Risk Factors in Graphites Annual Report on Form 10-K for the year ended December 31, 2022, as amended, filed with the SEC, subsequent Quarterly Reports on Form 10-Q filed with the SEC, and in other filings that Graphite makes and will make with the SEC in connection with the proposed Merger, including the Proxy Statement described below under Additional Information and Where to Find It. You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking statements. Graphite expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based. This communication does not purport to summarize all of the conditions, risks and other attributes of an investment in Graphite or LENZ.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities nor a solicitation of any vote or approval with respect to the proposed transaction or otherwise. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

This communication relates to the proposed Merger involving Graphite and LENZ and may be deemed to be solicitation material in respect of the proposed Merger. In connection with the proposed Merger, Graphite will file relevant materials with the SEC, including a registration statement on Form S-4 (the Form S-4) that will contain a proxy statement (the Proxy Statement) and prospectus. This communication is not a substitute for the Form S-4, the Proxy Statement or for any other document that Graphite may file with the SEC and or send to Graphites shareholders in connection with the proposed Merger. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF GRAPHITE ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GRAPHITE, THE PROPOSED MERGER AND RELATED MATTERS.

Investors and security holders will be able to obtain free copies of the Form S-4, the Proxy Statement and other documents filed by Graphite with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed by Graphite with the SEC will also be available free of charge on Graphites website at www.graphitebio.com, or by contacting Graphites Investor Relations at investors@graphitebio.com.

Participants in the Solicitation

Graphite, LENZ, and their respective directors and certain of their executive officers may be considered participants in the solicitation of proxies from Graphites shareholders with respect to the proposed Merger under the rules of the SEC. Information about the directors and executive officers of Graphite is set forth in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 20, 2023 and amended on April 27, 2023, subsequent Quarterly Reports on Form 10-Q and other documents that may be filed from time to time with the SEC. Additional information regarding the persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in the Form S-4, the Proxy Statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of this document as described above.

| Item 9.01. | Financial Statements and Exhibits. |

| Exhibit |

Description |

|

| 2.1* | Agreement and Plan of Merger, dated as of November 14, 2023, by and among Graphite Bio, Inc., Generate Merger Sub, Inc. and Lenz Therapeutics, Inc. | |

| 10.1 | Form of Graphite Support Agreement | |

| 10.2 | Form of LENZ Support Agreement | |

| 10.3 | Form of Lock-Up Agreement | |

| 10.4* | Subscription Agreement, dated as of November 14, 2023 | |

| 99.1 | Joint Press Release, issued on November 15, 2023 | |

| 99.2 | Investor Presentation, dated November 2023 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

| * | Exhibits and/or schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The registrant hereby undertakes to furnish supplementally copies of any of the omitted exhibits and schedules upon request by the SEC; provided, however, that the registrant may request confidential treatment pursuant to Rule 24b-2 under the Exchange Act for any exhibits or schedules so furnished. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Graphite Bio, Inc. | ||||||

| Date: November 15, 2023 | By: | /s/ Kim Drapkin |

||||

|

Kim Drapkin Chief Executive Officer |

||||||

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

by and among

GRAPHITE BIO, INC.,

GENERATE MERGER SUB, INC.

and

LENZ THERAPEUTICS, INC.

Dated as of November 14, 2023

ii

iii

iv

| Section 10.11 |

Severability | 98 | ||||

| Section 10.12 |

Waiver of Jury Trial | 98 | ||||

| Section 10.13 |

Counterparts | 98 | ||||

| Section 10.14 |

Facsimile or .pdf Signature | 98 | ||||

| Section 10.15 |

No Presumption Against Drafting Party | 98 |

| Exhibit A | Form of Certificate of Amendment | |

| Exhibit B | Form of Parent Support Agreement | |

| Exhibit C | Form of Company Support Agreement | |

| Exhibit D | Form of Lock-Up Agreement | |

| Exhibit E | Form of Subscription Agreement |

v

INDEX OF DEFINED TERMS

| Definition |

Location |

|

| 2023 Equity Incentive Plan |

1.1(a) | |

| 2023 Equity Incentive Plan Proposal |

7.15(a) | |

| 2023 ESPP |

1.1(b) | |

| 2023 ESPP Proposal |

7.15(b) | |

| 2023 Plans |

1.1(c) | |

| Acceptable Confidentiality Agreement |

1.1(d) | |

| Accounting Firm |

3.7(e) | |

| Acquisition Inquiry |

1.1(e) | |

| Acquisition Proposal |

1.1(f) | |

| Acquisition Transaction |

1.1(g) | |

| Action |

4.9 | |

| Adjusted Warrant |

3.3(c) | |

| Affiliate |

1.1(h) | |

| Agreement |

Preamble | |

| Allocation Certificate |

7.13 | |

| Amended Charter Proposals |

Recitals | |

| Anticipated Closing Date |

3.7(a) | |

| Book-Entry Shares |

3.4(b) | |

| Business Day |

1.1(i) | |

| Cash Determination Date |

3.7(a) | |

| Cash Dividend |

Recitals | |

| Certificate of Merger |

2.4 | |

| Certificates |

3.4(b) | |

| Charter Amendment Proposal |

Recitals | |

| Closing |

2.3 | |

| Closing Date |

2.3 | |

| COBRA |

4.12(c)(iv) | |

| Code |

Recitals | |

| Company |

Preamble | |

| Company Audited Financial Statements |

Section 7.1(g) | |

| Company Board |

Recitals | |

| Company Board Adverse Recommendation Change 7.2(c) Company Board Recommendation |

7.2(c) | |

| Company Budget |

6.2(b)(vi) | |

| Company Bylaws |

4.1(b) | |

| Company Capital Stock |

1.1(j) | |

| Company Charter |

4.1(b) | |

| Company Common Stock |

1.1(k) | |

| Company Disclosure Letter |

Article IV | |

| Company Equity Plan |

1.1(l) | |

| Company Financial Statements |

4.6(a) |

vi

| Company Fundamental Representations |

1.1(m) | |

| Company Interim Financial Statements |

4.6(a) | |

| Company Intervening Event |

7.2(d) | |

| Company Notice Period |

7.2(d) | |

| Company Options |

1.1(n) | |

| Company Outstanding Shares |

3.1(a)(i)(A) | |

| Company Owned IP |

1.1(o) | |

| Company Plans |

4.12(a) | |

| Company Preferred Stock |

1.1(p) | |

| Company Privacy Laws |

4.19(e) | |

| Company Products |

4.11(c) | |

| Company Restricted Shares |

3.2 | |

| Company Series B Preferred Stock |

1.1(q) | |

| Company Stock Awards |

4.2(b) | |

| Company Stockholder Approval |

Recitals | |

| Company Support Agreements |

Recitals | |

| Company Triggering Event |

1.1(r) | |

| Company Unaudited Interim Financial Statements |

Section 7.1(g) | |

| Company Valuation |

3.1(a)(i)(B) | |

| Company Value Per Share |

3.1(a)(i)(C) | |

| Company Warrant |

1.1(s) | |

| Concurrent PIPE Investment |

Recitals | |

| Concurrent PIPE Investment Amount |

Recitals | |

| Concurrent PIPE Investors |

Recitals | |

| Confidentiality Agreement |

1.1(t) | |

| Contract |

4.5(a) | |

| control |

1.1(u) | |

| Controlled Group |

4.12(b) | |

| D&O Indemnified Parties |

7.5(a) | |

| Delaware Secretary of State |

2.4 | |

| Delivery Date |

3.7(a) | |

| DGCL |

Recitals | |

| Dispute Notice |

3.7(b) | |

| Dissenting Shares |

3.6 | |

| Dividend Record Date |

7.14(a) | |

| Effective Time |

2.4 | |

| End Date |

9.1(b) | |

| Environmental Law |

4.14(b) | |

| Equity Plan Proposals |

7.15(a) | |

| ERISA |

4.12(a) | |

| Exchange Act |

4.5(b) | |

| Exchange Agent |

3.4(a) | |

| Exchange Fund |

3.4(a) | |

| Exchange Ratio |

3.1(a)(i) | |

| Excluded Shares |

3.1(a)(iii) | |

| FDA |

4.11(c) |

vii

| FDA Ethics Policy |

4.11(i) | |

| FDCA |

4.11(a) | |

| Final Parent Net Cash |

3.7(c) | |

| Form S-4 |

7.1(a) | |

| GAAP |

4.6(a) | |

| Governmental Entity |

4.5(b) | |

| Hazardous Substance |

4.14(c) | |

| Health Care Laws |

4.11(a) | |

| HSR Act |

1.1(v) | |

| Intellectual Property |

1.1(w) | |

| Intended Tax Treatment |

Recitals | |

| In-the-Money Parent Option |

7.15(c) | |

| Investor Agreements |

7.11 | |

| IRS |

4.12(a) | |

| IT Systems |

4.19(d) | |

| knowledge |

1.1(x) | |

| Law |

4.5(a) | |

| Liens |

4.5(a) | |

| Lock-Up Agreement |

Recitals | |

| Material Adverse Effect |

4.1(a) | |

| Material Company Registered IP |

4.19(a) | |

| Material Contracts |

4.16(a) | |

| Measurement Date |

5.2(a) | |

| Merger |

Recitals | |

| Merger Consideration |

3.1(a)(i) | |

| Merger Sub |

Preamble | |

| Minimum Net Cash |

7.14(a) | |

| Mitigated Lease Amounts |

1.1(y) | |

| Nasdaq |

1.1(z) | |

| Nasdaq Issuance Proposal |

Recitals | |

| Nasdaq Listing Application |

7.8 | |

| Nasdaq Reverse Stock Split |

1.1(aa) | |

| Net Cash |

1.1(bb) | |

| Ordinary Course Agreement |

4.15(g) | |

|

Out-of-the-Money Parent Option |

7.15(c) | |

| Parent |

Preamble | |

| Parent Board |

Recitals | |

| Parent Board Adverse Recommendation Change |

7.3(b) | |

| Parent Board Recommendation |

7.3(b) | |

| Parent Charter Amendment |

Recitals | |

| Parent Common Stock |

Recitals | |

| Parent Common Stock Issuance |

5.4(a) | |

| Parent Disclosure Letter |

Article V | |

| Parent Equity Plans |

5.2(a) | |

| Parent Facilities |

5.18(c) | |

| Parent Form 10-K |

1.1(cc) |

viii

| Parent Fundamental Representations |

1.1(dd) | |

| Parent Intervening Event |

7.3(c) | |

| Parent IT Systems |

5.19(d) | |

| Parent Lease Agreements |

5.18(c) | |

| Parent Lease Mitigation Agreements |

5.18(e) | |

| Parent Legacy Assets |

1.1(ee) | |

| Parent Legacy Business |

1.1(s) | |

| Parent Legacy Transaction |

6.1(d) | |

| Parent Material Adverse Effect |

5.1(a) | |

| Parent Material Contracts |

5.16(a) | |

| Parent Net Cash Calculation |

3.7(a) | |

| Parent Net Cash Schedule |

3.7(a) | |

| Parent Notice Period |

7.3(c) | |

| Parent Options |

5.2(a) | |

| Parent Outstanding Shares |

3.1(a)(i)(D) | |

| Parent Owned IP |

1.1(ff) | |

| Parent Plans |

5.12(a) | |

| Parent Products |

4.12(c) | |

| Parent Registered IP |

5.19(a) | |

| Parent Restricted Stock Awards |

1.1(gg) | |

| Parent SEC Documents |

5.6(a) | |

| Parent Stockholder Approval |

5.4(a) | |

| Parent Stockholder Meeting |

7.3(a) | |

| Parent Stockholder Proposals |

7.3(a) | |

| Parent Sublease Agreements |

5.18(d) | |

| Parent Sublease Premises |

5.18(d) | |

| Parent Support Agreements |

Recitals | |

| Parent Target Net Cash |

1.1(hh) | |

| Parent Triggering Event |

1.1(ii) | |

| Parent Valuation |

3.1(a)(i)(E) | |

| Parent Value Per Share |

3.1(a)(i)(F) | |

| PBGC |

4.12(c)(iv) | |

| Pension Plan |

4.12(b) | |

| Permits |

4.10 | |

| Permitted Financing |

1.1(jj) | |

| Permitted Liens |

4.18(a) | |

| Permitted Stock Purchase Agreement |

1.1(kk) | |

| Person |

1.1(ll) | |

| Personal Information |

4.19(e) | |

| Pre-Closing Period |

6.1(a) | |

| Proxy Statement |

6.1(a) | |

| Registration Statement |

7.1(a) | |

| Representative |

1.1(mm) | |

| Response Date |

3.7(b) | |

| Reverse Stock Split Proposal |

Recitals | |

| Safety Notices |

4.11(g) |

ix

| Sarbanes-Oxley Act |

4.6(a) | |

| SEC |

1.1(nn) | |

| Securities Act |

4.5(b) | |

| Stockholder Notice |

7.2(b) | |

| Subscription Agreement |

Recitals | |

| Subsequent Transaction |

1.1(oo) | |

| Subsidiary |

1.1(pp) | |

| Superior Offer |

1.1(qq) | |

| Surviving Company |

2.2 | |

| Takeover Laws |

4.20 | |

| Tax Action |

4.15(c) | |

| Tax Return |

1.1(rr) | |

| Taxes |

1.1(ss) | |

| Termination Fee |

9.3(b) | |

| Transaction Expenses |

1.1(tt) | |

| Transaction Litigation |

7.4(c) | |

| Transfer Taxes |

7.9(c) | |

| WARN Act |

4.13(d) | |

| Withholding Agent |

3.5 |

x

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this Agreement), dated as of November 14, 2023, by and among Graphite Bio, Inc., a Delaware corporation (Parent), Generate Merger Sub, Inc., a Delaware corporation (Merger Sub), and Lenz Therapeutics, Inc., a Delaware corporation (the Company).

RECITALS

WHEREAS, Parent and the Company intend to effect a merger of Merger Sub with and into the Company (the Merger) in accordance with this Agreement and the General Corporation Law of the State of Delaware (the DGCL). Upon consummation of the Merger, Merger Sub will cease to exist and the Company will become a wholly-owned subsidiary of Parent;

WHEREAS, the parties hereto intend that the Merger qualify as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the Code) and the Treasury Regulations promulgated thereunder, and that this Agreement be, and hereby is, adopted as a plan of reorganization for the purposes of Section 368 of the Code and Treasury Regulations Section 1.368-2(g) (the Intended Tax Treatment);

WHEREAS, the Board of Directors of the Company (the Company Board) has (i) determined that the transactions contemplated hereby are fair to, advisable and in the best interests of the Company and its stockholders, (ii) approved and declared advisable this Agreement and the transactions contemplated hereby and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of the Company vote to adopt this Agreement and thereby approve the transactions contemplated hereby;

WHEREAS, the Company Board has approved this Agreement and the Merger, with the Company continuing as the Surviving Company (as defined below), after the Effective Time (as defined below), pursuant to which each share of Company Capital Stock shall be converted into the right to receive a number of shares of common stock, par value $0.00001 per share, of Parent (the Parent Common Stock) equal to the Exchange Ratio, upon the terms and subject to the conditions set forth in this Agreement;

WHEREAS, Merger Sub is a newly incorporated Delaware corporation that is wholly- owned by Parent, and has been formed for the sole purpose of effecting the Merger;

WHEREAS, effective as of the Closing, the certificate of incorporation of Parent shall be amended in the form attached hereto as Exhibit A (with such changes as may be mutually agreed between Parent and the Company, the Parent Charter Amendment );

WHEREAS, the Board of Directors of Parent (the Parent Board) has (i) determined that the transactions contemplated hereby are fair to, advisable and in the best interests of Parent and its stockholders, (ii) approved and declared advisable this Agreement and the transactions contemplated hereby, including the issuance of shares of Parent Common Stock to the stockholders of the Company pursuant to this Agreement and the Parent Support Agreements, (iii) determined and declared that the Charter Amendment Proposals are advisable and in the best interests of Parent and its stockholders, (iv) determined to recommend, upon the terms and subject to the conditions

set forth in this Agreement, that the stockholders of Parent vote to authorize the issuance of the Parent Common Stock in accordance with Nasdaq Listing Rule 5635 (the Nasdaq Issuance Proposal) and (v) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, as promptly as practicable after the forms thereof are mutually agreed to by Parent and the Company, that the stockholders of Parent vote to approve one or more amendments to Parents certificate of incorporation to (a) effect the Nasdaq Reverse Stock Split (the Reverse Stock Split Proposal), and (b) amend Parents certificate of incorporation in the form of the Parent Charter Amendment (the Amended Charter Proposals, and together with the Reverse Stock Split Proposal, the Charter Amendment Proposals);

WHEREAS, the board of directors of Merger Sub has (i) determined that the transactions contemplated hereby are fair to, advisable and in the best interests of Merger Sub and its sole stockholder, (ii) approved and declared advisable this Agreement and the transactions contemplated hereby and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholder of Merger Sub votes to adopt this Agreement and thereby approve the transactions contemplated hereby;

WHEREAS, Parent, Merger Sub and the Company each desire to make certain representations, warranties, covenants and agreements in connection with the Merger and also to prescribe certain conditions to the Merger as specified herein;

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement to the Companys willingness to enter into this Agreement, the officers, directors and stockholders of Parent listed on Section A of the Parent Disclosure Letter have entered into Parent Support Agreements, dated as of the date of this Agreement, in the form attached hereto as Exhibit B (the Parent Support Agreements), pursuant to which such officers, directors and stockholders have, subject to the terms and conditions set forth therein, agreed to vote all of their shares of Parent Common Stock in favor of the approval of the Parent Stockholder Proposals;

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement of Parents willingness to enter into this Agreement, the officers, directors and stockholders of the Company listed on Section A of the Company Disclosure Letter have entered into Company Support Agreements, dated as of the date of this Agreement, in the form attached hereto as Exhibit C (the Company Support Agreements), pursuant to which such officers, directors and stockholders have, subject to the terms and conditions set forth therein, agreed to vote all of their shares of Company Capital Stock in favor of the adoption of this Agreement and thereby approve the transactions contemplated hereby;

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement to Parents willingness to enter into this Agreement, certain stockholders of the Company listed on Section B of the Company Disclosure Letter are executing lock-up agreements in the form attached hereto as Exhibit D (the Lock-Up Agreement);

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement to Companys willingness to enter into this Agreement, certain

2

stockholders of Parent listed on Section B of the Parent Disclosure Letter are executing Lock-Up Agreements;

WHEREAS, it is expected that after the Registration Statement is declared effective under the Securities Act, the stockholders of the Company will execute an action by written consent by the holders of (i) at least a majority of the voting power of outstanding shares of Company Capital Stock, (ii) at least a majority of the outstanding shares of Company Preferred Stock and (iii) at least a majority of the outstanding shares of Company Series B Preferred Stock, approving and adopting this Agreement (collectively, subclauses (i), (ii), and (iii), the Company Stockholder Approval);

WHEREAS, the stockholders of Parent as of the Dividend Record Date (which for clarity shall exclude holders of Parent Common Stock issued as part of the Merger Consideration) shall be entitled to receive from Parent a cash dividend in an aggregate amount of $60,000,000, subject to certain adjustments as set forth herein (the Cash Dividend); and

WHEREAS, concurrently with the execution of this Agreement, certain investors (each a Concurrent PIPE Investor and collectively the Concurrent PIPE Investors) have entered into stock purchase agreements representing an aggregate commitment of not less than $50,000,000 (the Concurrent PIPE Investment Amount) in the form attached hereto as Exhibit E (collectively, the Subscription Agreement), pursuant to which such Persons will agree, subject to the terms and conditions set forth therein, to subscribe and purchase a number of shares of Parent Common Stock immediately following the Closing (the Concurrent PIPE Investment).

AGREEMENT

NOW, THEREFORE, in consideration of the premises, and of the representations, warranties, covenants and agreements contained herein, and intending to be legally bound hereby, Parent, Merger Sub and the Company hereby agree as follows:

DEFINITIONS & INTERPRETATIONS

Section 1.1 Certain Definitions. For purposes of this Agreement:

(a) 2023 Equity Incentive Plan shall mean an equity incentive plan of Parent in form and substance as agreed to by Parent and the Company (such agreement not to be unreasonably withheld, conditioned or delayed by either party), reserving for issuance a number of shares of Parent Common Stock to be determined by the Company in consultation with Parent.

(b) 2023 ESPP shall mean an employee stock purchase plan of Parent in form and substance as agreed to by Parent and the Company (such agreement not to be unreasonably withheld, conditioned or delayed by either party), reserving for issuance a number of shares of Parent Common Stock to be determined by the Company in consultation with Parent.

(c) 2023 Plans shall mean both the 2023 Equity Incentive Plan and 2023 ESPP.

3

(d) Acceptable Confidentiality Agreement means a confidentiality agreement containing terms not materially less restrictive in the aggregate to the counterparty thereto than the terms of the Confidentiality Agreement, except such confidentiality agreement need not contain any standstill, non-solicitation or no hire provisions. Notwithstanding the foregoing, a Person who has previously entered into a confidentiality agreement with Parent relating to a potential Acquisition Proposal on terms that are not materially less restrictive than the Confidentiality Agreement with respect to the scope of coverage and restrictions on disclosure and use shall not be required to enter into a new or revised confidentiality agreement, and such existing confidentiality agreement shall be deemed to be an Acceptable Confidentiality Agreement.

(e) Acquisition Inquiry means, with respect to a party, an inquiry, indication of interest or request for information (other than an inquiry, indication of interest or request for information made or submitted by the Company, on the one hand, or Parent, on the other hand, to the other party) that could reasonably be expected to lead to an Acquisition Proposal, other than the Concurrent PIPE Investment or a Permitted Financing.

(f) Acquisition Proposal means, with respect to either Parent or the Company, any proposal or offer from any Person (other than Parent or the Company, as applicable, or their respective Representatives) providing for (i) the acquisition or purchase by such Person from a party of a substantial portion of such partys or any of its subsidiaries capital stock or material assets or (ii) any merger, consolidation, recapitalization or other business combination transaction involving such party (other than in connection with the Concurrent PIPE Investment, a Permitted Financing, Parents leases, a Parent Legacy Transaction or the exercise or repurchase of existing equity interests).

(g) Acquisition Transaction means any transaction or series of related transactions (other than the Concurrent PIPE Investment or a Permitted Financing) involving:

(i) any merger, consolidation, amalgamation, share exchange, business combination, issuance of securities, acquisition of securities, reorganization, recapitalization, tender offer, exchange offer or other similar transaction: (i) in which a party is a constituent entity, (ii) in which a Person or group (as defined in the Exchange Act and the rules promulgated thereunder) of Persons directly or indirectly acquires beneficial or record ownership of securities representing more than 20% of the outstanding securities of any class of voting securities of a party or any of its Subsidiaries or (iii) in which a party or any of its Subsidiaries issues securities representing more than 20% of the outstanding securities of any class of voting securities of such party or any of its Subsidiaries; or

(ii) any sale, lease, exchange, transfer, license, acquisition or disposition of any business or businesses or assets that constitute or account for 20% or more of the consolidated book value of the fair market value of the assets of a party and its Subsidiaries, taken as a whole.

(h) Affiliate of any Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such first Person.

4

(i) Business Day means any day other than a Saturday, a Sunday or a day on which banks in New York, New York are authorized or required by applicable Law to be closed.

(j) Company Capital Stock means the outstanding shares of Company Common Stock and Company Preferred Stock.

(k) Company Common Stock means the outstanding shares of common stock of the Company with a par value per share of $0.001.

(l) Company Equity Plan means the Companys 2020 Equity Incentive Plan, as amended.

(m) Company Fundamental Representations means each of the representations and warranties of the Company set forth in Section 4.1, Section 4.2, Section 4.3, Section 4.4, Section 4.5(a), and Section 4.24.

(n) Company Options means options or other rights to purchase shares of Company Common Stock issued by the Company.

(o) Company Owned IP means all Intellectual Property owned by the Company in whole or in part.

(p) Company Preferred Stock means the outstanding shares of preferred stock of the Company with a par value per share of $0.001, including, for the avoidance of doubt, the Company Series B Preferred Stock.

(q) Company Series B Preferred Stock means the outstanding shares of Company Preferred Stock designated as Series B Preferred Stock.

(r) Company Triggering Event shall be deemed to have occurred if: (a) the Company Board shall have approved, endorsed or recommended any Acquisition Proposal, (b) the Company Board shall have made a Company Board Adverse Recommendation Change, or (c) the Company shall have entered into any letter of intent or similar document or any Contract relating to any Acquisition Proposal (other than an Acceptable Confidentiality Agreement permitted pursuant to Section 6.4).

(s) Company Warrant means each warrant to purchase Company Capital Stock.

(t) Confidentiality Agreement means that certain non-disclosure agreement, dated as of September 6, 2023, between the Company and Parent.

(u) control (including the terms controlled, controlled by and under common control with) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

5

(v) HSR Act means the U.S. Hart Scott-Rodino Antitrust Improvements Act of 1976, as amended.

(w) Intellectual Property means all intellectual property rights of any kind or nature in any jurisdiction throughout the world, including all of the following to the extent protected by applicable law: (i) trademarks or service marks (whether registered or unregistered), trade names, domain names, social media user names, social media addresses, logos, slogans, and trade dress, including applications to register any of the foregoing, together with the goodwill symbolized by any of the foregoing; (ii) patents, utility models and any similar or equivalent statutory rights with respect to the protection of inventions, and all applications for any of the foregoing, together with all re-issuances, continuations, continuations-in-part, divisionals, revisions, extensions and reexaminations thereof; (iii) copyrights (registered and unregistered) and applications for registration; (iv) trade secrets and customer lists, in each case to the extent any of the foregoing derives economic value (actual or potential) from not being generally known to other Persons who can obtain economic value from its disclosure or use, and other confidential information (Trade Secrets); and (v) any other proprietary or intellectual property rights of any kind or nature.

(x) knowledge of any party means (i) the actual knowledge of any executive officer of such party or other officer having primary responsibility for the relevant matter or any employee consultant or interim officer serving similar roles (ii) any fact or matter which any such Person could be expected to discover or otherwise become aware of after reasonable inquiry, consistent with such Persons title and responsibilities, concerning the existence of the relevant matter.

(y) Mitigated Lease Amounts means any amounts under a Parent Lease Agreement for which Parent has no liability, either on an absolute or contingent basis, as of the Closing.

(z) Nasdaq means the Nasdaq Stock Market, LLC.

(aa) Nasdaq Reverse Stock Split means a reverse stock split of all issued shares of Parent Common Stock at a reverse stock split ratio as mutually agreed to by Parent and the Company that is effectuated by Parent for the purpose of maintaining compliance with Nasdaq listing standards.

(bb) Net Cash means (i) Parents cash, cash equivalents and short-term investments, plus (ii) all prepaid expenses, deposits, receivables and restricted cash that Parent and the Company mutually agree will be useable by or available to the Company within 90 days of Closing, minus (iii) the sum of Parents short-term and long-term liabilities and any unpaid Transaction Expenses accrued at the Closing Date (including any costs, fees or other liabilities, including, without limitation, Taxes, related to the Cash Dividend, the preparation and filing of Parents Form 10-K, including the preparation and audit of the related audited financial statements, the premiums, commissions and other fees paid or payable in connection with obtaining Parents D&O tail policy as set forth in Section 7.5(d)), minus (iv) all payables or obligations, whether absolute, contingent or otherwise, related to the Parent Lease Agreements (net of any Mitigated Lease Amounts) minus (v) to the extent payable in cash at Closing and not yet paid, any and all

6

liabilities of Parent to any of its employees (including change of control payments, retention payments, severance payments and any employer-side portion of any payroll or similar Taxes owed in connection with the foregoing or any of Parents equity plans), minus (vi) the actual costs, or, to the extent not available as of the Cash Determination Time, the mutually agreed estimate for costs associated with the termination of ongoing contractual obligations relating to all Parent Material Contracts and/or the Parent Legacy Business, minus (vii) all actual and reasonably projected costs and expenses relating to the winding down of Parents prior research and development activities, minus (viii) any and all liabilities of Parent resulting from or in connection with the application of Section 280G of the Code in connection with the Merger. Set forth on Section 1.1(bb) of the Parent Disclosure Letter is an illustrative example of the calculation of Net Cash.

(cc) Parent Form 10-K means Parents Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

(dd) Parent Fundamental Representations means each of the representations and warranties of Parent and Merger Sub set forth in Section 5.1(a), Section 5.1(b), Section 5.2, Section 5.3, Section 5.4, Section 5.5(a), Section 5.6(i), Section 5.22 and Section 5.24.

(ee) Parent Legacy Assets means all assets, technology and Intellectual Property of Parent as they existed at any time prior to the date of this Agreement, including for purposes of clarity, the tangible and intangible assets, in each case to the extent primarily used in or primarily related to Parents nulabeglogene autogedtemcel (nula-cel) program, beta-thalassemia program, therapeutic protein production (alpha-globin) program, X-linked combined deficiency syndrome (XSCID) program, Gaucher disease program, and related pre-clinical platform assets and the Non-Genotoxic Targeted Conditioning Technology Assets (NGTC). The business of Parent with respect to the Parent Legacy Assets, the Parent Legacy Business).

(ff) Parent Owned IP means all Intellectual Property owned by Parent in whole or in part.

(gg) Parent Restricted Stock Awards means each award with respect to a share of Parent Common Stock outstanding under any Parent Plan subject to risk of forfeiture or repurchase by Parent.

(hh) Parent Target Net Cash means $175,000,000 of Net Cash at the Closing.

(ii) Parent Triggering Event shall be deemed to have occurred if: (a) Parent shall have failed to include in the Proxy Statement the Parent Board Recommendation, (b) the Parent Board or any committee thereof shall have made a Parent Board Adverse Recommendation Change or approved, endorsed or recommended any Acquisition Proposal or (c) Parent shall have entered into any letter of intent or similar document or any Contract relating to any Acquisition Proposal (other than an Acceptable Confidentiality Agreement permitted pursuant to Section 6.4).

(jj) Permitted Financing means purchases of Parent Common Stock immediately following the Closing pursuant to Section 7.16, or otherwise as agreed between Parent and the Company.

7

(kk) Permitted Stock Purchase Agreement means a Contract executed pursuant to which the signatory has agreed to purchase for cash shares of Parent Common Stock immediately following the Closing pursuant to Section 7.16, or otherwise as agreed between Parent and the Company.

(ll) Person means an individual, corporation, partnership, limited liability company, association, trust or other entity or organization, including any Governmental Entity.

(mm) Representative means a partys directors, officers, employees, investment bankers, financial advisors, attorneys, accountants or other advisors, agents or representatives.

(nn) SEC means the Securities and Exchange Commission.

(oo) Subsequent Transaction means any Acquisition Transaction (with all references to 20% in the definition of Acquisition Transaction being treated as references to 50% for these purposes).

(pp) Subsidiary means, with respect to any Person, any other Person of which stock or other equity interests having ordinary voting power to elect more than 50% of the board of directors or other governing body are owned, directly or indirectly, by such first Person.

(qq) Superior Offer means an unsolicited bona fide written Acquisition Proposal (with all references to 20% in the definition of Acquisition Transaction being treated as references to 50% for these purposes) that: (a) was not obtained or made as a direct or indirect result of a breach of (or in violation of) the Agreement and (b) is on terms and conditions that the Parent Board or the Company Board, as applicable, determines in good faith, based on such matters that it deems relevant (including the likelihood of consummation thereof and the financing terms thereof), as well as any written offer by the other party to the Agreement to amend the terms of the Agreement, and following consultation with its outside legal counsel and financial advisors, if any, are more favorable, from a financial point of view, to the Parents stockholders or the Companys stockholders, as applicable, than the terms of the transactions contemplated hereby.

(rr) Tax Return means any return, declaration, report, certificate, bill, election, claim for refund, information return, statement or other written information and any other document filed or supplied or required to be filed or supplied to (or as directed by) any Governmental Entity or any other Person with respect to Taxes, including any schedule, attachment or supplement thereto, and including any amendment thereof.

(ss) Taxes means all U.S. federal, state and local and non-U.S. net income, gross income, gross receipts, sales, use, stock, ad valorem, transfer, transaction, franchise, profits, gains, registration, license, wages, lease, service, service use, employee and other withholding, imputed underpayment, social security, unemployment, welfare, disability, payroll, employment, excise, severance, stamp, occupation, workers compensation, premium, real property, personal property, escheat or unclaimed property, windfall profits, net worth, capital, value-added, alternative or add-on minimum, customs duties, estimated and other taxes, fees, assessments, charges or levies in the nature of a Tax (whether imposed, assessed, determined, administered, enforced or collected directly or through withholding and including taxes of any third party in respect of which a Person may have a duty to collect or withhold and remit and any amounts

8

resulting from the failure to file any Tax Return), whether disputed or not, together with any interest and any penalties, additions to tax or additional amounts with respect thereto (or attributable to the nonpayment thereof).

(tt) Transaction Expenses means the aggregate amount (without duplication) of all costs, fees, Taxes and expenses incurred by Parent and Merger Sub, or for which Parent or Merger Sub are or may become liable in connection with the transactions contemplated hereby and the negotiation, preparation and execution of this Agreement or any other agreement, document, instrument, filing, certificate, schedule, exhibit, letter or other document prepared or executed in connection with the transactions contemplated hereby, including (i) 50% of any Transfer Taxes, (ii) any fees and expenses of legal counsel and accountants, (iii) the maximum amount of fees and expenses payable to financial advisors, investment bankers, brokers, consultants, Tax advisors, transfer agents, proxy solicitor and other advisors of Parent, including any Taxes incurred or to be incurred by Parent or Merger Sub with respect to the payment of any item listed in this definition of Transaction Expenses (including the employer-side portion of any payroll or similar Tax), (iv) all fees and expenses incurred in relation to the printing and filing with the SEC of the Registration Statement (including any financial statements and exhibits) and any amendments or supplements thereto and paid to a financial printer or the SEC, (v) all costs and expenses incurred in connection with the engagement and services of the Exchange Agent, and (vi) 50% of the filing fees of Parent in connection with the HSR Act; provided, however, that Transaction Expenses shall specifically exclude (A) any fees and expenses of any placement agent incurred in respect of the Concurrent PIPE Investment, (B) the value of any settlement or judgment that is awarded post-Closing relating to stockholder litigation arising out of or in connection with the transactions contemplated by this Agreement, (C) any filing fees payable in respect of the Nasdaq Listing Application, and (D) 50% of the filing fees of Parent in connection with the HSR Act.

Section 1.2 Interpretation. When a reference is made in this Agreement to a Section, Article, Exhibit or Schedule such reference shall be to a Section, Article, Exhibit or Schedule of this Agreement unless otherwise indicated. The table of contents and headings contained in this Agreement or in any Exhibit or Schedule are for convenience of reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. All words used in this Agreement will be construed to be of such gender or number as the circumstances require. Any capitalized terms used in any Exhibit or Schedule but not otherwise defined therein shall have the meaning as defined in this Agreement. All Exhibits and Schedules annexed hereto or referred to herein are hereby incorporated in and made a part of this Agreement as if set forth herein. The word including and words of similar import when used in this Agreement will mean including, without limitation, unless otherwise specified. The words hereof, herein and hereunder and words of similar import when used in this Agreement shall refer to the Agreement as a whole and not to any particular provision in this Agreement. The term or is not exclusive. The word will shall be construed to have the same meaning and effect as the word shall. References to days mean calendar days unless otherwise specified.

Section 1.3 Currency. All references to dollars or $ or US$ in this Agreement refer to United States dollars, which is the currency used for all purposes in this Agreement.

9

THE MERGER

Section 2.1 Formation of Merger Sub. Parent has caused Merger Sub to be organized under the laws of the State of Delaware.

Section 2.2 The Merger. Upon the terms and subject to the conditions set forth in this Agreement and in accordance with the DGCL, at the Effective Time, Merger Sub shall be merged with and into the Company. Following the Merger, the separate corporate existence of Merger Sub shall cease, and the Company shall continue as the surviving company of the Merger (the Surviving Company) and a wholly-owned subsidiary of Parent.

Section 2.3 Closing. Unless this Agreement is earlier terminated pursuant to the provisions of Article IX, and subject to the satisfaction or waiver of the conditions set forth in Article VIII, the consummation of the Merger (the Closing) shall take place remotely by the electronic exchange of documents, as promptly as practicable (but in no event later than the second Business Day following the satisfaction or waiver of the last to be satisfied or waived of the conditions set forth in Article VIII, other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of each of such conditions), unless another time, date and place is mutually agreed upon by Parent and the Company in writing. The date on which the Closing actually takes place is referred to as the Closing Date.

Section 2.4 Effective Time. Upon the terms and subject to the provisions of this Agreement, at the Closing, the parties shall cause the Merger to be consummated by executing and filing a certificate of merger with respect to the Merger (the Certificate of Merger) with the Secretary of State of the State of Delaware (the Delaware Secretary of State), in such form as is required by, and executed in accordance with the relevant provisions of the DGCL. The Merger shall become effective at such time as the Certificate of Merger is duly filed with the Delaware Secretary of State or at such other time as Parent and the Company shall agree in writing and shall specify in the Certificate of Merger (the time the Merger becomes effective being the Effective Time).

Section 2.5 Effects of the Merger. At and after the Effective Time, the Merger shall have the effects set forth in this Agreement and in the relevant provisions of the DGCL. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the property, rights, privileges, powers and franchises of the Company and Merger Sub shall vest in the Surviving Company, and all debts, liabilities and duties of the Company and Merger Sub shall become the debts, liabilities and duties of the Surviving Company.

Section 2.6 Parent Governance.

(a) Parent Certificate of Incorporation. At the Effective Time, the certificate of incorporation of Parent shall be amended in the form of the Parent Charter Amendment by filing the Parent Charter Amendment with the Secretary of State of Delaware, until thereafter amended in accordance with its terms and as provided by applicable Law.

10

(b) Parent Bylaws. The Bylaws of Parent shall remain in effect as of and following the Effective Time, until thereafter amended in accordance with their terms and as provided by applicable Law.

(c) Board of Directors. The parties shall take all action necessary (including, to the extent necessary, procuring the resignation of any directors on the Parent Board immediately prior to the Effective Time) so that, as of the Effective Time, the number of directors that comprise the full Board of Directors of Parent shall be seven (7) (or such other number of directors as Parent and the Company may mutually agree), and such Board of Directors shall upon the Effective Time initially consist of the Persons set forth in Section 2.6(c) of the Parent Disclosure Letter, which each Person shall be appointed to the particular class set forth on such schedule.

(d) Parent Officers. The parties shall take all action necessary (including, to the extent necessary, procuring the resignation or removal of any officers of Parent immediately prior to the Effective Time) so that, as of the Effective Time, the Parent officers shall initially consist of the Persons set forth in Section 2.6(d) of the Parent Disclosure Letter.

Section 2.7 Surviving Company Governance.

(a) Surviving Company Certificate of Incorporation. At the Effective Time, the Certificate of Incorporation of the Surviving Company shall, by virtue of the Merger and without any further action, be amended and restated to read in its entirety as set forth in an exhibit to the Certificate of Merger, and, as so amended and restated, shall be the Certificate of Incorporation of the Surviving Company until thereafter amended in accordance with applicable Law.

(b) Surviving Company Bylaws. At the Effective Time, the Bylaws of the Surviving Company shall be amended and restated to read in their entirety as the Bylaws of Merger Sub as in effect immediately prior to the Effective Time (except that references to the name of Merger Sub shall be replaced with references to the name of the Surviving Company), and, as so amended and restated, shall be the Bylaws of the Surviving Company until thereafter amended in accordance with applicable Law.

(c) Surviving Company Directors. The directors of Parent immediately following the Effective Time shall be the directors of the Surviving Company until the earlier of their resignation or removal or until their respective successors are duly elected and qualified.

(d) Surviving Company Officers. The officers of Parent immediately following the Effective Time shall be the officers of the Surviving Company until the earlier of their resignation or removal or until their respective successors are duly elected and qualified.

11

EFFECT ON THE CAPITAL STOCK OF THE CONSTITUENT COMPANIES; EXCHANGE OF CERTIFICATES

Section 3.1 Conversion of Capital Stock.

(a) At the Effective Time, by virtue of the Merger and without any action on the part of Parent, Merger Sub, the Company or the holders of any shares of capital stock of Parent, Merger Sub or the Company:

(i) Subject to Section 3.4(f), each share of Company Capital Stock issued and outstanding immediately prior to the Effective Time (other than any Excluded Shares, Dissenting Shares, but including any Company Restricted Shares which shall be subject to Section 3.2 below) shall be converted into and become exchangeable for the right to receive, in exchange for (i) each share of Company Common Stock, a number of shares of Parent Common Stock equal to the Exchange Ratio and (ii) each share of Company Preferred Stock, a number of shares of Parent Common Stock equal to the Exchange Ratio multiplied by the aggregate number of shares of Company Common Stock into which each such share of Company Preferred Stock is then convertible (the Merger Consideration ). As of the Effective Time, all such shares of Company Capital Stock shall no longer be outstanding and shall automatically be cancelled and shall cease to exist, and shall thereafter only represent the right to receive the Merger Consideration. For purposes of this Agreement, the Exchange Ratio shall mean the ratio (rounded to four decimal places) equal to (a) the Company Value Per Share divided by (b) the Parent Value Per Share, in which:

(A) Company Outstanding Shares means the total number of shares of Company Capital Stock outstanding on a fully diluted basis immediately prior to the Effective Time, assuming the exercise, conversion and exchange of all options, warrants, conversion rights, exchange rights or any other rights to receive shares of Company Capital Stock which exist immediately prior to the Effective Time.

(B) Company Valuation means $231,600,000, provided, however, that if the Companys valuation implied by the pricing of the Concurrent PIPE Investment and/or the Permitted Financing is other than $231,600,000 as agreed by the investors in the Concurrent PIPE Investment and/or the Permitted Financing, the Company Valuation will be adjusted on a dollar-for-dollar basis to match such amount.

(C) Company Value Per Share equals the Company Valuation divided by the number of Company Outstanding Shares.

(D) Parent Outstanding Shares means the total number of shares of Parent Common Stock outstanding immediately prior to the Effective Time (including, without limitation, taking into account the effects of the Nasdaq Reverse Stock Split and the termination of the Out-of-the-Money Parent Options pursuant to Section 7.15(c)) calculated using the treasury stock method, assuming the exercise, conversion or exchange of all options, warrants, conversion rights, exchange rights or any other rights to receive shares of Parent Common Stock which exist immediately prior to the Effective Time. For clarity, all outstanding Parent Options

12

shall be included in the total number of shares of Parent Common Stock for purposes of determining the Parent Outstanding Shares, to the extent not terminated prior to the Closing, and no shares issued in connection with the Concurrent PIPE Investment shall be included in the Parent Outstanding Shares.