DEF 14A: Definitive proxy statements

Published on April 28, 2025

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

April 28, 2025,

Dear Fellow Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of LENZ Therapeutics, Inc. (“LENZ”), to be held on Tuesday, June 10, 2025 at 10:00 a.m., Pacific Time. The annual meeting will be conducted live via the Internet. You will be able to attend the annual meeting virtually by visiting www.proxydocs.com/LENZ, where you will be able to register to listen to the meeting live, submit questions and vote online.

The attached formal meeting notice and proxy statement contain details of the business to be conducted at the annual meeting.

Your vote is important. Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the annual meeting. Therefore, we urge you to vote and submit your proxy promptly via the Internet, telephone or mail.

On behalf of our Board of Directors, we would like to express our appreciation for your continued support of and interest in LENZ.

Sincerely,

Evert Schimmelpennink

President and Chief Executive Officer

LENZ THERAPEUTICS, INC.

201 Lomas Santa Fe Drive, Suite 300

Solana Beach, California 92075

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Time and Date | 10:00 a.m., Pacific Time, on Tuesday, June 10, 2025 | |

| Place | The annual meeting (including any postponements, adjournments or continuations thereof, the “annual meeting”) will be conducted virtually via live audio webcast. You will be able to register to attend the annual meeting virtually by visiting www.proxydocs.com/LENZ, where you will be able to listen to the meeting live, submit questions and vote online during the meeting. If you have difficulty accessing the virtual meeting during the check-in or meeting time, a technical assistance phone number will be made available on the virtual meeting registration page 15 minutes prior to the start time of the meeting. | |

| Items of Business | • To elect two Class III directors to hold office until our 2027 annual meeting of stockholders and two Class I directors to hold office until our 2028 annual meeting of stockholders, each until their respective successors are elected and qualified.

• To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2025.

• To transact any other business that may properly come before the annual meeting or any adjournments or postponements thereof. |

|

| Record Date | The close of business on April 14, 2025

Only stockholders of record as of the close of business on April 14, 2025 are entitled to notice of and to vote at the annual meeting. |

|

| Availability of Proxy Materials | The Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement, notice of annual meeting, form of proxy and our annual report, is first being sent or given on or about April 28, 2025 to all stockholders entitled to notice of and to vote at the annual meeting.

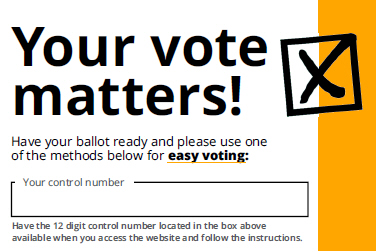

The proxy materials and our annual report can be accessed as of April 28, 2025 by visiting www.proxydocs.com/LENZ and using your 12 digit control number on the proxy card. |

|

| Voting | Your vote is important. Whether or not you plan to attend the annual meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone or mail as soon as possible. | |

| By order of the Board of Directors, |

|

| Evert Schimmelpennink |

| President and Chief Executive Officer |

| Solana Beach, California |

| April 28, 2025 |

TABLE OF CONTENTS

LENZ THERAPEUTICS, INC.

PROXY STATEMENT

FOR 2025 ANNUAL MEETING OF STOCKHOLDERS

To be held at 10:00 a.m., Pacific Time, on Tuesday, June 10, 2025

This proxy statement and the enclosed form of proxy are being furnished in connection with the solicitation of proxies by our board of directors for use at our 2025 annual meeting of stockholders, and any postponements, adjournments or continuations thereof. You will be able to attend the annual meeting virtually by visiting www.proxydocs.com/LENZ, where you will be able to listen to the annual meeting live, submit questions and vote online by entering the control number on your Notice of Internet Availability or proxy card.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

The information provided in the “question and answer” format below addresses certain frequently asked questions but is not intended to be a summary of all matters contained in this proxy statement. Please read the entire proxy statement carefully before voting your shares. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

What is LENZ Therapeutics, Inc.’s relationship to Graphite Bio, Inc.? What is the Merger?

On March 21, 2024 (the “Closing Date”), LENZ Therapeutics, Inc., a Delaware corporation (previously named Graphite Bio, Inc., a Delaware corporation and our predecessor company (“Graphite”)), consummated the previously announced merger pursuant to the terms of the Agreement and Plan of Merger, dated as of November 14, 2023 (the “Merger Agreement”), by and among Graphite, Generate Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Graphite (“Generate Merger Sub”) and LENZ Therapeutics Operations, Inc. (previously named Lenz Therapeutics, Inc.), a Delaware corporation (“LENZ OpCo”).

Pursuant to the Merger Agreement, on the Closing Date, (i) Graphite effected a reverse stock split of Graphite’s issued common stock at a ratio of 1:7, (ii) Graphite changed its name to “LENZ Therapeutics, Inc.”, and (iii) Generate Merger Sub merged with and into LENZ OpCo (the “Merger”), with LENZ OpCo as the surviving company in the Merger and, after giving effect to such Merger, LENZ OpCo becoming a wholly-owned subsidiary of LENZ Therapeutics, Inc. (together with its consolidated subsidiary, “New LENZ” or “LENZ”).

Why am I receiving these materials?

This proxy statement and the form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2025 annual meeting of stockholders of LENZ Therapeutics, Inc., a Delaware corporation, and any postponements, adjournments or continuations thereof (the “annual meeting”). The annual meeting will be held on Tuesday, June 10, 2025 at 10:00 a.m., Pacific Time. The annual meeting will be conducted virtually via the Internet. You will be able to attend the annual meeting virtually by visiting www.proxydocs.com/LENZ, where you will be able to listen to the meeting live, submit questions and vote online during the meeting. Stockholders can go to www.proxydocs.com/LENZ to register to attend the virtual meeting. Stockholders who register to attend will receive an email containing a link to the virtual meeting one hour prior to the meeting start time.

The Notice of Internet Availability of Proxy Materials, or Notice of Internet Availability, containing instructions on how to access this proxy statement, the accompanying notice of annual meeting and form of proxy, and our annual report, is first being sent or given on or about April 28, 2025, to all stockholders of record as of the close of business on April 14, 2025 (the “record date”). The proxy materials and our annual report can be accessed as of April 28, 2025, by visiting www.proxydocs.com/LENZ. If you receive a Notice of Internet Availability, then you will not receive a printed copy of the proxy materials or our annual report in the mail unless you specifically request these materials. Instructions for requesting a printed copy of the proxy materials and our annual report are set forth in the Notice of Internet Availability.

What proposals will be voted on at the annual meeting?

The following proposals will be voted on at the annual meeting:

| • | the election of two Class III directors to hold office until our 2027 annual meeting of stockholders and two Class I directors to hold office until our 2028 annual meeting of stockholders, each until their respective successors are elected and qualified; |

| • | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2025; |

| • | any other business that may properly come before the annual meeting or any adjournments or postponements thereof. |

As of the date of this proxy statement, our management and board of directors were not aware of any other matters to be presented at the annual meeting.

How does the board of directors recommend that I vote on these proposals?

Our board of directors recommends that you vote your shares:

| • | “FOR” the election of each Class III and Class I director nominee named in this proxy statement; and |

| • | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2025. |

Who is entitled to vote at the annual meeting?

Holders of our common stock as of the close of business on April 14, 2025, the record date for the annual meeting, may vote at the annual meeting. As of the record date, there were 27,544,520 shares of our common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the annual meeting. Stockholders are not permitted to cumulate votes with respect to the election of directors.

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Equiniti Trust Company, LLC, then you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability was sent directly to you by us. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote on your own behalf at the annual meeting. Throughout this proxy statement, we refer to these holders as “stockholders of record.”

Street Name Stockholders. If your shares are held in a brokerage account or by a broker, bank or other nominee, then you are considered the beneficial owner of shares held in street name, and the Notice of Internet Availability was forwarded to you by your broker, bank or other nominee, which is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account by following the instructions that your broker, bank or other nominee sent to you. Throughout this proxy statement, we refer to these holders as “street name stockholders.”

Is there a list of registered stockholders entitled to vote at the annual meeting?

A list of registered stockholders entitled to vote at the annual meeting will be made available for examination by any stockholder for any purpose germane to the meeting for a period of at least ten days prior to the meeting between the hours of 9:00 a.m. and 4:30 p.m., Pacific Time, at our principal executive offices located at 201 Lomas Santa Fe Drive, Suite 300, Solana Beach, California 92075 by contacting our corporate secretary. The list will also be open to the examination of any stockholder during the whole time of the meeting as provided by law.

How many votes are needed for approval of each proposal?

| • | Proposal No. 1: Each director is elected by a plurality of the votes properly cast on the election of directors. A plurality means that the nominees of each class of directors to be elected at the annual meeting with the largest number of FOR votes are elected as directors. You may (1) vote FOR the election of all of the director nominees named herein, (2) WITHHOLD your vote for all director nominees, or (3) vote FOR all director nominees except for those specific director nominees from whom you WITHHOLD your vote. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a |

-2-

| result of choosing to WITHHOLD authority to vote or a broker non-vote, will have no effect on the outcome of the election. |

| • | Proposal No. 2: The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2025 requires the affirmative vote of a majority of the votes properly cast. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions are not considered votes cast and thus will have no effect on the outcome of this proposal. Because this is a routine proposal, we do not expect any broker non-votes on this proposal. |

What is the quorum requirement for the annual meeting?

A quorum is the minimum number of shares required to be present or represented at the annual meeting for the meeting to be properly held under our amended and restated bylaws and Delaware law. The presence, in person (including virtually) or by proxy, of a majority of the shares of our capital stock issued and outstanding and entitled to vote will constitute a quorum to transact business at the annual meeting. Abstentions, choosing to withhold authority to vote and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, stockholders representing a majority of the voting power present at the meeting or the presiding officer of the meeting may adjourn the meeting to another time or place.

How do I vote and what are the voting deadlines?

Stockholder of Record. If you are a stockholder of record, you may vote in one of the following ways:

| • | by Internet at www.proxypush.com/LENZ, 24 hours a day, 7 days a week, until 10:00 a.m. Pacific Time on June 10, 2025 (have your Notice of Internet Availability or proxy card in hand when you visit the website); |

| • | by toll-free telephone at 1-866-437-3790, 24 hours a day, 7 days a week, until 10:00 a.m. Pacific Time on June 10, 2025 (have your Notice of Internet Availability or proxy card in hand when you call); |

| • | by completing, signing and mailing your proxy card (if you received printed proxy materials), which must be received prior to the annual meeting; or |

| • | by attending the annual meeting virtually by visiting www.proxydocs.com/LENZ, where you may vote during the meeting (have your Notice of Internet Availability or proxy card in hand when you visit the website, you will need your 12 digit control number on your proxy card). |

Street Name Stockholders. If you are a street name stockholder, then you will receive voting instructions from your broker, bank or other nominee. The availability of Internet and telephone voting options will depend on the voting process of your broker, bank or other nominee. We therefore recommend that you follow the voting instructions in the materials you receive from your broker, bank or other nominee. If your voting instruction form or notice of internet availability of proxy materials indicates that you may vote your shares through the proxyvote.com website, then you may vote those shares at the annual meeting with the control number indicated on that voting instruction form or notice of internet availability of proxy materials. Otherwise, you may not vote your shares at the annual meeting unless you obtain a legal proxy from your broker, bank or other nominee.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

| • | “FOR” the election of all Class III and Class I director nominees named in this proxy statement; and |

| • | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2025. |

In addition, if any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Street Name Stockholders. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely

-3-

directions, your broker, bank or other nominee will have discretion to vote your shares on our sole routine matter: the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2025. Your broker, bank or other nominee will not have discretion to vote on any other proposals, which are considered non-routine matters, absent direction from you. In the event that your broker, bank or other nominee votes your shares on our sole routine matter, but is not able to vote your shares on the non-routine matters, then those shares will be treated as broker non-votes with respect to the non-routine proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals.

Can I change my vote or revoke my proxy?

Stockholder of Record. If you are a stockholder of record, you can change your vote or revoke your proxy before the annual meeting by:

| • | entering a new vote by Internet or telephone (subject to the applicable deadlines for each method as set forth above); |

| • | completing and returning a later-dated proxy card, which must be received prior to the annual meeting; |

| • | delivering a written notice of revocation to our corporate secretary at LENZ Therapeutics, Inc., 201 Lomas Santa Fe Drive, Suite 300, Solana Beach, California 92075, Attention: Corporate Secretary, which must be received prior to the annual meeting; or |

| • | attending and voting at the annual meeting (although attendance at the annual meeting will not, by itself, revoke a proxy). |

Street Name Stockholders. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

What do I need to do to attend the annual meeting?

We will be hosting the annual meeting via live audio webcast only.

Stockholder of Record. If you were a stockholder of record as of the record date, then you may attend the annual meeting virtually, and will be able to submit your questions during the meeting and vote your shares electronically during the meeting by visiting www.proxydocs.com/LENZ. To attend and participate in the annual meeting, you will need the control number included on your Notice of Internet Availability or proxy card. The annual meeting live audio webcast will begin promptly at 10:00 a.m., Pacific Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:45 a.m., Pacific Time, and you should allow ample time for the check-in procedures.

Street Name Stockholders. If you were a street name stockholder as of the record date and your voting instruction form or notice of internet availability of proxy materials indicates that you may vote your shares through the proxyvote.com website, then you may access and participate in the annual meeting with the control number indicated on that voting instruction form or notice of internet availability of proxy materials. Otherwise, street name stockholders should contact their bank, broker or other nominee and obtain a legal proxy in order to be able to attend and participate in the annual meeting.

How can I get help if I have trouble checking in or listening to the annual meeting online?

If you encounter difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Evert Schimmelpennink, our President and Chief Executive Officer, and Daniel Chevallard, our Chief Financial Officer, have been designated as proxy holders for the annual meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the annual meeting in accordance with the instructions of the stockholder. If the proxy is dated and signed, but no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors on the proposals as described above. If any other matters are properly brought before the annual meeting, then the proxy holder will use their own judgment to determine how to vote your shares. If the annual meeting is postponed

-4-

or adjourned, then the proxy holder can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

How can I contact LENZ’s transfer agent?

You may contact our transfer agent, Equiniti Trust Company, LLC, by telephone at (800) 937-5449, or by writing Equiniti Trust Company, LLC, at 48 Wall Street 22nd Floor, New York, NY 10005. You may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at https://equiniti.com/us/.

How are proxies solicited for the annual meeting and who is paying for such solicitation?

Our board of directors is soliciting proxies for use at the annual meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communications or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation.

Where can I find the voting results of the annual meeting?

We will disclose voting results on a Current Report on Form 8-K that we will file with the U.S. Securities and Exchange Commission, or SEC, within four business days after the meeting. If final voting results are not available to us in time to file a Form 8-K within such timeframe, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

Why did I receive a Notice of Internet Availability instead of a full set of proxy materials?

In accordance with the rules of the SEC we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability instead of a paper copy of the proxy materials. The Notice of Internet Availability contains instructions on how to access our proxy materials on the Internet, how to vote on the proposals, how to request printed copies of the proxy materials and our annual report, and how to request to receive all future proxy materials in printed form by mail or electronically by e-mail. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

What does it mean if I receive more than one Notice of Internet Availability or more than one set of printed proxy materials?

If you receive more than one Notice of Internet Availability or more than one set of printed proxy materials, then your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice of Internet Availability or each set of printed proxy materials, as applicable, to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one copy of the Notice of Internet Availability or proxy statement and annual report. How may I obtain an additional copy of the Notice of Internet Availability or proxy statement and annual report?

We have adopted a procedure approved by the SEC called “householding,” under which we can deliver a single copy of the Notice of Internet Availability and, if applicable, the proxy statement and annual report, to multiple stockholders who share the same address unless we receive contrary instructions from one or more stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice of Internet Availability and, if applicable, the proxy statement and annual report, to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request

-5-

that we only send a single copy of next year’s Notice of Internet Availability or proxy statement and annual report, as applicable, you may contact us as follows:

LENZ Therapeutics, Inc.

Attention: Investor Relations

201 Lomas Santa Fe Drive, Suite 300

Solana Beach, California 92075

Tel: (858) 925-7000

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

Implications of being an “emerging growth company” and smaller reporting company.

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding nonbinding advisory votes on executive compensation and stockholder approval of any golden parachute payments not previously approved. We will cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we have total annual gross revenue of $1.235 billion or more, (ii) the last day of our fiscal year following the fifth anniversary of the date of the closing of Graphite’s initial public offering (i.e., December 31, 2026), (iii) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission.

We are also a “smaller reporting company,” meaning that the market value of our stock held by non-affiliates is less than $700 million and our annual revenue was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company if either (i) the market value of our stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements.

-6-

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Composition of the Board

Our board of directors currently consists of seven directors, six of whom are independent under the listing standards of The Nasdaq Stock Market LLC, or Nasdaq. Our board of directors is divided into three classes with staggered three-year terms. Thus, at each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose term is then expiring. However, since as a result of the Merger we did not hold an annual meeting of stockholders in 2024, the terms of each of our Class III directors and Class I directors expire at the 2025 annual meeting of stockholders, and thus Class III directors will be elected at our 2025 annual meeting of stockholders to hold office until our 2027 annual meeting of stockholders and Class I directors will be elected at our 2025 annual meeting of stockholders to hold office until our 2028 annual meeting of stockholders, each until their respective successors are elected and qualified.

The following table sets forth the names, ages as of April 14, 2025, and certain other information for each of our directors and director nominees:

| Name | Class | Age | Position(s) | Director Since | Current Term Expires |

Expiration of Term for Which Nominated |

||||||||

| Nominees for Director |

||||||||||||||

| Kimberlee C. Drapkin(1)(2) |

III | 57 | Director | 2023 | 2025 | 2027 | ||||||||

| Zach Scheiner(1)(3) |

III | 48 | Director | 2024 | 2025 | 2027 | ||||||||

| Frederic Guerard(2)(3) |

I | 52 | Director | 2024 | 2025 | 2028 | ||||||||

| James McCollum |

I | 70 | Director | 2024 | 2025 | 2028 | ||||||||

| Continuing Directors |

||||||||||||||

| Evert Schimmelpennink |

II | 53 | Chief Executive Officer, President, Secretary, and Director | 2024 | 2026 | — | ||||||||

| Jeff George(1) |

II | 51 | Chairperson | 2024 | 2026 | — | ||||||||

| Shelley Thunen(2)(3) |

II | 72 | Director | 2024 | 2026 | — | ||||||||

| (1) | Member of the nominating and corporate governance committee. |

| (2) | Member of the compensation committee. |

| (3) | Member of the audit committee. |

Nominees for Director

Kimberlee C. Drapkin has served a member of our board of directors since July 2023. Ms. Drapkin served as interim president and chief executive officer of Graphite Bio, Inc. from August 2023 through the closing of the Merger. Ms. Drapkin has over 25 years of experience working with private and publicly traded biotechnology and pharmaceutical companies, including building and leading finance functions, raising capital, and leading strategic financial planning. Prior to joining Graphite Bio, Ms. Drapkin was the Chief Financial Officer at Jounce Therapeutics, Inc., a biotechnology company, a position she held from August 2015 until the company’s acquisition by Concentra Biosciences, LLC in May 2023, playing a key role in building Jounce’s financial infrastructure. Prior to joining Jounce, Ms. Drapkin owned a financial consulting firm where she served as the interim chief financial officer for numerous early-stage biotechnology companies. Previously, she was the Chief Financial Officer at EPIX Pharmaceuticals, Inc. and also spent ten years in roles of increasing responsibility within the finance organization at Millennium Pharmaceuticals, Inc. Ms. Drapkin’s career began in the technology and life sciences practice at PriceWaterhouseCoopers LLP. Ms. Drapkin served as a member of the board of directors of Proteostasis Therapeutics, Inc. until the completion of the merger of Proteostasis and Yumanity Therapeutics, Inc., at which point she became a member of the Yumanity board of directors. Ms. Drapkin then served on the board of directors of Yumanity through the completion of its reverse merger with Kineta, Inc. She currently serves on the board of directors of Acumen Pharmaceuticals, Inc. (Nasdaq: ABOS), Imugene Limited (ASX: IMU), Kineta, Inc. (Nasdaq: KA), and Climb Bio, Inc. (Nasdaq: CLYM), where she is a member of the audit committee at all four companies. Ms. Drapkin holds a B.S. in accounting from Babson College.

We believe Ms. Drapkin is qualified to serve on our board of directors because of her role as the chief executive officer of Graphite Bio, Inc. prior to the Merger and extensive experience in the life sciences industry.

-7-

Zach Scheiner, Ph.D. has served as a member of our board of directors since March 2024. Dr. Scheiner served as a member of LENZ OpCo’s board of directors from October 2020 through the closing of the Merger. Dr. Scheiner joined RA Capital Management, L.P., an investment manager, in April 2015 as an associate, became an analyst in April 2017, and has been a principal since December 2017. Prior to joining RA Capital, Dr. Scheiner was a Science Officer at the California Institute for Regenerative Medicine (CIRM), where he worked from September 2008 to March 2015. Dr. Scheiner currently serves on the board of directors of Nkarta Therapeutics, Inc. (Nasdaq: NKTX) and several private biotechnology companies. Dr. Scheiner holds a B.S. in Molecular Biophysics and Biochemistry from Yale University and a Ph.D. in Neurobiology and Behavior from the University of Washington.

We believe Dr. Scheiner is qualified to serve on our board of directors because of his experience in the life sciences industry and his investing experience.

Frederic Guerard, Pharm.D. has served as a member of our board of directors since March 2024 and served on the LENZ OpCo board of directors from September 2021 through the closing of the Merger. Since October 2023, Dr. Guerard has served as Chief Executive Officer of Opthea Limited (Nasdaq: OPT; ASX: OPT), a biopharmaceutical company. Dr. Guerard served as the President and Chief Executive Officer of Graybug Vision, Inc. from February 2019 until March 2023. From 1999 to February 2019, Dr. Guerard held key leadership roles at Novartis AG, a multinational pharmaceutical company, including Worldwide Business Franchise Head of Ophthalmology from April 2016 to February 2019, Global Franchise Head of Pharmaceuticals at Alcon Laboratories, a Novartis company, from May 2015 to April 2016, Managing Director of the United Kingdom and Ireland from July 2012 to April 2015, and Country President and Managing Director of Australia and New Zealand from April 2009 to July 2012, among others. Dr. Guerard currently serves on the board of directors of CalciMedica, Inc. (Nasdaq: CALC). Dr. Guerard holds a Pharm.D. and a Master of Biological and Medical Sciences from the University of Rouen, France and a Master of Marketing from HEC Paris.

We believe Dr. Guerard is qualified to serve on our board of directors because of his extensive drug development experience and his experience serving in various leadership positions in biotechnology companies.

James McCollum has served as a member of our board of directors since March 2024. Mr. McCollum co-founded LENZ OpCo and served on LENZ OpCo’s board of directors from July 2013 through the closing of the Merger. From September 2016 to March 2021, Mr. McCollum served as LENZ’s President and Chief Executive Officer. From September 2014 to September 2016, Mr. McCollum served as President and Chief Executive Officer of Eye Therapies, LLC, an ocular pharmaceutical company co-founded by Mr. McCollum. Previously, Mr. McCollum served as the President and Chief Executive Officer of Restoration Robotics, a medical robotics company, President and Chief Executive Officer of Vision Membrane Technologies, an intraocular lens medical device company, and President and Chief Executive Officer of Argus Biomedical, an artificial cornea medical device company. Earlier in his career, Mr. McCollum held the position of Senior Vice President of Worldwide Marketing and Sales at VISX, Incorporated, a developer of technology and systems for laser vision correction. Mr. McCollum holds a B.A. in Business from North Carolina State University.

We believe Mr. McCollum is qualified to serve on our board of directors because of his deep knowledge of our business and strategy, his extensive executive leadership and operational experience.

Continuing Directors

Evert Schimmelpennink has served as our President and Chief Executive Officer and a member of our board of directors since March 2024. Mr. Schimmelpennink served as LENZ OpCo’s President and Chief Executive Officer and a member of its board of directors from March 2021 through the closing of the Merger. Previously, from August 2017 to October 2020, Mr. Schimmelpennink served as President and Chief Executive Officer and a member of the board of directors of publicly listed Pfenex, Inc., a biopharmaceutical company, until its acquisition by Ligand Pharmaceuticals Inc. (Nasdaq: LGND) in late 2020. From November 2019 until its sale, Mr. Schimmelpennink also served as the acting Principal Financial Officer and Principal Accounting Officer of Pfenex Inc. From October 2015 to August 2017, Mr. Schimmelpennink served as Chief Executive Officer of Alvotech, a biopharmaceutical company. Prior to that, Mr. Schimmelpennink held senior positions at Pfizer Inc. (NYSE: PFE) and Hospira, Inc. within their global specialty injectables businesses, as well as Synthon BV. Mr. Schimmelpennink currently serves on the board of directors of iBio, Inc. (NYSE: IBIO) and Contineum Therapeutics (f/k/a Pipeline Therapeutics). Mr. Schimmelpennink holds a M.Sc. in Bioprocess Engineering from the University of Wageningen in the Netherlands and a business degree from the Arnhem Business School.

We believe Mr. Schimmelpennink is qualified to serve on our board of directors because of his knowledge of our business and his extensive leadership and operational experience within the pharmaceutical and biotech industries.

-8-

Jeff George has served as a member of our board of directors and as Chair since March 2024. Since January 2017, Mr. George has served as the Managing Partner of Maytal Capital, a healthcare-focused private equity investment and advisory firm he founded. Between 2008 and 2016, Mr. George served on the Executive Committee of Novartis Group AG, a pharmaceutical company, first as Division Head and CEO of Sandoz, Novartis’ generic pharmaceuticals and biosimilars subsidiary, and then as Division Head and CEO of Alcon, Novartis’ then eye care subsidiary. Mr. George previously headed Emerging Markets for the Middle East, Africa, Southeast Asia and CIS at Novartis Pharmaceuticals and served as Vice President and Head of Western and Eastern Europe for Novartis Vaccines. Prior to this, Mr. George held leadership roles at Gap Inc. and McKinsey & Co. Mr. George serves on the boards of directors of Amneal Pharmaceuticals, Inc. (Nasdaq: AMRX), a generics and specialty pharmaceuticals company, 908 Devices (Nasdaq: MASS), a pioneer in life science diagnostics, Dorian Therapeutics, a cellular senescence biotech spun out of Stanford University, and MAPS PBC, a late-stage CNS-focused private biopharma company where he serves as chairman of the board. Mr. George also currently serves on several non-profit boards and previously served as the Chairman of Education Opens Doors. Mr. George has also served as an Operating Partner at Revival Healthcare Capital, a medical device-focused private equity firm. Mr. George holds an M.B.A. from Harvard Business School, an M.A. from Johns Hopkins University’s School of Advanced International Studies, and a B.A. from Carleton College.

We believe Mr. George is qualified to serve on our board of directors because of his extensive industry background and experience in the life sciences industry.

Shelley Thunen has served as a member of our board of directors since March 2024. Ms. Thunen served as a member of LENZ OpCo’s board of directors from November 2023 through the closing of the Merger. Since February 2017, Ms. Thunen has served as Chief Financial Officer of RxSight, Inc. (Nasdaq: RXST), an ophthalmic medical technology company, and served as RxSight’s Chief Administrative Officer from January 2016 to February 2017. From January 2013 to October 2015, Ms. Thunen served as the Chief Financial Officer of Endologix, Inc. (Nasdaq: ELGX), a medical device company. From August 2010 to December 2012, Ms. Thunen served as Associate General Manager of Alcon LenSx, Inc., a medical device company. Prior to Alcon’s (NYSE: ALC) acquisition of LenSx, Inc. in August 2010, Ms. Thunen served as a board member and chair of the audit committee from April 2008 to August 2010, as well as Chief Financial Officer and Vice President, Operations from November 2009 to August 2010. Ms. Thunen joined IntraLase Corp. (Nasdaq: ILSE), a laser technology company, in May 2001 and was its Chief Financial Officer and later Executive Vice President & Chief Financial Officer until its acquisition by Advanced Medical Optics, Inc. (NYSE: EYE) in April 2007. Ms. Thunen serves on the board of directors and as audit committee chair of AEON Biopharma, Inc. (NYSE: AEON). Ms. Thunen holds a B.A. in economics and an M.B.A. from the University of California, Irvine.

We believe Ms. Thunen is qualified to serve on our board of directors because of her extensive experience in the biotechnology industry and her leadership experience as a senior financial executive.

Director Independence

Our common stock is listed on Nasdaq. As a company listed on Nasdaq, we are required under Nasdaq listing rules to maintain a board comprised of a majority of independent directors as determined affirmatively by our board. Under Nasdaq listing rules, a director will only qualify as an independent director if, in the opinion of that listed company’s board of directors, the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In addition, the Nasdaq listing rules require that, subject to specified exceptions, each member of our audit, compensation and nominating and corporate governance committees be independent.

Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Nasdaq listing rules applicable to audit committee members. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and Nasdaq listing rules applicable to compensation committee members.

Our board of directors has undertaken a review of the independence of each of our directors. Our board of directors has determined that none of Ms. Thunen, Dr. Guerard, Dr. Scheiner, Ms. Drapkin, Mr. George and Mr. McCollum, representing six of our seven directors, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under the listing standards of Nasdaq. Evert Schimmelpennink is not considered an independent director because of his position as our Chief Executive Officer, President, and Secretary.

In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances that our board of directors deemed relevant

-9-

in determining their independence, including the transactions involving them described in the section titled “Related Person Transactions.”

There are no family relationships among any of our directors or executive officers.

Board Leadership Structure

Our corporate governance framework provides our board flexibility to determine the appropriate leadership structure for the Company, and whether the roles of chairperson and chief executive officer should be separated or combined. In making this determination, our board considers many factors, including the needs of the business, our board’s assessment of its leadership needs from time to time and the best interests of our stockholders. If the role of chairperson is filled by a director who does not qualify as an independent director, then our corporate governance guidelines provide that one of our independent directors may serve as our lead independent director.

Our board believes that it is currently appropriate to separate the roles of chairperson and chief executive officer. The chief executive officer is responsible for day-to-day leadership, while our chairperson, along with the rest of our independent directors, ensures that our board’s time and attention is focused on providing independent oversight of management and matters critical to our company. The board believes that Mr. George’s deep knowledge of the Company and industry, as well as strong leadership and governance experience, enable Mr. George to lead our board effectively and independently.

Role of Board in Risk Oversight Process

One of the key functions of our board of directors is informed oversight of the risk management process. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through our board of directors as a whole, as well as through various standing committees of our board of directors that address risks inherent in their respective areas of oversight. In particular our board of directors is responsible for monitoring and assessing strategic risk exposure and our audit committee has the responsibility to consider and discuss major financial risk exposures as well as risks and exposures associated with cybersecurity, information security and privacy matters, and the steps our management takes to monitor and control such exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements. Our compensation committee is responsible for overseeing the management of risks relating to executive compensation plans and arrangements. The compensation committee also assesses and monitors whether compensation plans, policies and programs comply with applicable legal and regulatory requirements.

Committees of the Board of Directors

Our board of directors has three standing committees: an audit committee, a compensation committee, and a nominating and corporate governance committee.

Audit Committee

The current members of our audit committee are Shelley Thunen, Frederic Guerard and Zach Scheiner, and Ms. Thunen serves as the chairperson of the audit committee. Under the Nasdaq listing rules and applicable SEC rules, we are required to have at least three members of the audit committee. The rules of Nasdaq and Rule 10A-3 of the Exchange Act require that the audit committee of a listed company be composed solely of independent directors for audit committee purposes, and each member must qualify as an independent director for audit committee purposes under applicable rules. Shelley Thunen, Zach Scheiner and Frederic Guerard are each financially literate and Shelley Thunen qualifies as an “audit committee financial expert” as defined in applicable SEC rules.

The functions of our audit committee include, among other things, the authority and responsibility to:

| • | select, retain, compensate, evaluate, oversee and, where appropriate, terminate our independent registered public accounting firm; |

| • | review and approve the scope and plans for the audits and the audit fees and approve all non-audit and tax services to be performed by the independent auditor; |

| • | evaluate the independence and qualifications of our independent registered public accounting firm; |

| • | review our financial statements, and discuss with management and our independent registered public accounting firm the results of the annual audit and the quarterly reviews; |

-10-

| • | review and discuss with management and our independent registered public accounting firm the quality and adequacy of our internal controls and our disclosure controls and procedures; |

| • | discuss with management our procedures regarding the presentation of our financial information, and review earnings press releases and guidance; |

| • | oversee the design, implementation and performance of our internal audit function, if any; |

| • | set hiring policies with regard to the hiring of employees and former employees of our independent auditor and oversee compliance with such policies; |

| • | review, approve and monitor related party transactions; |

| • | adopt and oversee procedures to address complaints regarding accounting, internal accounting controls and auditing matters, including confidential, anonymous submissions by our employees of concerns regarding questionable accounting or auditing matters; |

| • | review and discuss with management and our independent auditor the adequacy and effectiveness of our legal, regulatory and ethical compliance programs; and |

| • | review and discuss with management and our independent auditor our guidelines and policies to identify, monitor and address enterprise risks, including major financial risks exposures and risks and exposures associated with cybersecurity, information security and privacy matters. |

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq, available on our website at https://ir.lenz-tx.com/corporate-governance. Following the closing of the Merger through December 31, 2024, our audit committee held four meetings.

Compensation Committee

The members of our compensation committee are Frederic Guerard, Kimberlee C. Drapkin and Shelley Thunen, and Dr. Guerard serves as the chairperson of the compensation committee. Our board of directors has determined that each of the members of the compensation committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act and satisfies the independence requirements of Nasdaq.

The functions of our compensation committee include, among other things, the authority and responsibility to:

| • | review, approve or make recommendations to our board of directors regarding the compensation for our executive officers, including our chief executive officer; |

| • | review, approve and administer our employee benefit and equity incentive plans; |

| • | establish and review the compensation plans and programs of our employees, and ensure that they are consistent with our general compensation strategy; |

| • | make recommendations to our board of directors regarding non-employee director compensation; |

| • | monitor compliance with any stock ownership guidelines; and |

| • | approve or make recommendations to our board of directors regarding the creation or revision of any clawback policy. |

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq, available on our website at https://ir.lenz-tx.com/corporate-governance. Following the closing of the Merger through December 31, 2024, our compensation committee held two meetings.

Nominating and Corporate Governance Committee

The current members of our nominating and corporate governance committee are Jeff George, Kimberlee C. Drapkin, and Zach Scheiner, and Mr. George serves as the chair of the nominating and corporate governance committee. Our board of directors has determined that each of the members of our nominating and corporate governance committee satisfy the independence requirements of Nasdaq.

-11-

The functions of our nominating and corporate governance committee include, among other things, the authority and responsibility to:

| • | review and assess and make recommendations to our board of directors regarding desired qualifications, expertise and characteristics sought of board members; |

| • | identify, evaluate, select or make recommendations to our board of directors regarding nominees for election to our board of directors; |

| • | develop policies and procedures for considering stockholder nominees for election to our board of directors; |

| • | review our succession planning process for our chief executive officer and any other members of our executive management team; |

| • | review and make recommendations to our board of directors regarding the composition, organization and governance of our board of directors and its committees; |

| • | review and make recommendations to our board of directors regarding our corporate governance guidelines and corporate governance framework; |

| • | oversee director orientation for new directors and continuing education for our directors; |

| • | oversee the evaluation of the performance of our board of directors and its committees; |

| • | review and monitor compliance with our code of business conduct and ethics, and review conflicts of interest of our board members and officers other than related party transactions reviewed by our audit committee; and |

| • | administer policies and procedures for communications with the non-management members of our board of directors. |

Our nominating and corporate governance committee operates under a written charter, available on our website at https://ir.lenz-tx.com/corporate-governance, that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq. Following the closing of the Merger through December 31, 2024, our nominating and corporate governance committee held one meeting.

Role of Board in Cybersecurity Oversight

One of the key functions of our board of directors is informed oversight of our risk management process, including risks from cybersecurity threats. Our board of directors is responsible for monitoring and assessing strategic risk exposure, and our executive officers are responsible for the day-to-day management of the material risks we face. Our board of directors administers its cybersecurity risk oversight function directly as a whole, as well as through the audit committee.

Our Chief Financial Officer is primarily responsible for the assessment and management of our material risks from cybersecurity threats, and the oversight of our cybersecurity policies and processes, including those described in “Risk Management and Strategy” above. Our Chief Financial Officer and our third party managed IT service provider collectively have significant prior work experience in various roles involving managing information security and implementing effective information and cybersecurity programs. They are informed about and monitor the prevention, mitigation, detection and remediation of cybersecurity incidents. Our information technology general controls are firmly established based on recognized industry standards and cover areas such as risk management, data backup, and disaster recovery. We have implemented processes to monitor security threats and vulnerabilities and respond to all cybersecurity incidents that could have an impact on our business operations, including prompt escalation and communication of major security incidents to senior leadership and our board of directors.

Our Chief Financial Officer provides annual briefings to the audit committee regarding the Company’s cybersecurity risks and activities, including any recent cybersecurity incidents and related responses, cybersecurity systems testing, activities of third parties, and the like. The audit committee provides regular updates to the board of directors on such reports.

For additional information regarding our cybersecurity risk management and governance, please refer to our Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

-12-

Attendance at Board and Stockholder Meetings

Following the Merger through December 31, 2024, our board of directors held six meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (1) the total number of meetings of the board of directors held during the period for which he or she was a director and (2) the total number of meetings held by all committees on which he or she served during the periods that he or she served as a director.

Although we do not have a formal policy regarding attendance by members of our board of directors at the annual meetings of stockholders, we encourage, but do not require, directors to attend.

Executive Sessions of Non-Employee Directors

To encourage and enhance communication among non-employee directors, and as required under applicable Nasdaq rules, our corporate governance guidelines provide that the non-employee directors will meet in executive sessions without management directors or management present on a periodic basis but no less than two times a year. In addition, if any of our non-employee directors are not independent directors, then our independent directors will also meet in executive session on a periodic basis but no less than two times a year.

Compensation Committee Interlocks and Insider Participation

Following the Merger, the members of our compensation committee were Frederic Guerard, Kimberlee C. Drapkin and Shelley Thunen. None of the members of our compensation committee has ever been an executive officer or employee of the Company, other than Ms. Drapkin who served as interim President and Chief Executive Officer of Graphite, and an employee of Graphite, until immediately prior to the consummation of the Merger. None of our executive officers currently serve, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity that has one or more executive officers that serves as a member of the board of directors or our compensation committee.

Considerations in Evaluating Director Nominees

Our nominating and governance committee uses a variety of methods for identifying and evaluating potential director nominees. In its evaluation of director candidates, including the current directors eligible for re-election, our nominating and governance committee will consider the current size and composition of our board of directors and the needs of our board of directors and the respective committees of our board of directors and other director qualifications. While our board has not established minimum qualifications for board members, some of the factors that our nominating and governance committee considers in assessing director nominee qualifications include, without limitation, issues of character, professional ethics and integrity, judgment, business experience and diversity, and with respect to diversity, such factors as race, ethnicity, gender, differences in professional background, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on our board. Although our board of directors does not maintain a specific policy with respect to board diversity, our board of directors believes that the board should be a diverse body, and the nominating and governance committee considers a broad range of perspectives, backgrounds and experiences.

If our nominating and governance committee determines that an additional or replacement director is required, then the committee may take such measures as it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, board or management.

After completing its review and evaluation of director candidates, our nominating and governance committee recommends to our full board of directors the director nominees for selection. Our nominating and governance committee has discretion to decide which individuals to recommend for nomination as directors and our board of directors has the final authority in determining the selection of director candidates for nomination to our board.

Stockholder Recommendations and Nominations to our Board of Directors

Our nominating and governance committee will consider recommendations and nominations for candidates to our board of directors from stockholders in the same manner as candidates recommended to the committee from other sources, so long as such recommendations and nominations comply with our amended and restated certificate of incorporation and amended and restated bylaws, all applicable company policies and all applicable laws, rules and regulations, including those

-13-

promulgated by the SEC. Our nominating and governance committee will evaluate such recommendations in accordance with its charter, our bylaws and corporate governance guidelines and the director nominee criteria described above.

A stockholder that wants to recommend a candidate to our board of directors for consideration by our nominating and governance committee should direct the recommendation in writing by letter to our corporate secretary at LENZ Therapeutics, Inc., 201 Lomas Santa Fe Drive Suite 300, Solana Beach, California 92075, Attention: Corporate Secretary. In accordance with our corporate governance guidelines, such recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and us and evidence of the recommending stockholder’s ownership of our common stock. Such recommendation must also include a statement from the recommending stockholder in support of the candidate. Stockholder recommendations must be received by December 31st of the year prior to the year in which the recommended candidates will be considered for nomination. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also directly nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and the rules and regulations of the SEC, including but not limited to Rule 14a-8 and Rule 14a-19 under the Exchange Act, and should be sent in writing to our corporate secretary at the address above.

Communications with the Board of Directors

Stockholders and other interested parties wishing to communicate directly with our non-management directors, may do so by writing and sending the correspondence to our Chief Executive Officer or Chief Financial Officer by mail to our principal executive offices at LENZ Therapeutics, Inc., 201 Lomas Santa Fe Drive Suite 300, Solana Beach, California 92075. Our Chief Executive Officer or Chief Financial Officer, in consultation with appropriate directors as necessary, will review all incoming communications and screen for communications that (1) are solicitations for products and services, (2) relate to matters of a personal nature not relevant for our stockholders to act on or for our board to consider and (3) matters that are of a type that are improper or irrelevant to the functioning of our board or our business, for example, mass mailings, job inquiries and business solicitations. If appropriate, our Chief Executive Officer or Chief Financial Officer will route such communications to the appropriate director(s) or, if none is specified, then to the chairperson of the board or the lead independent director (if one is appointed). These policies and procedures do not apply to communications to non-management directors from our officers or directors who are stockholders or stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Policy Prohibiting Hedging or Pledging of Securities

Under our insider trading policy, our employees, including our executive officers, and the members of our board of directors are prohibited from, directly or indirectly, among other things, (1) engaging in short sales, (2) trading in publicly-traded options, such as puts and calls, and other derivative securities with respect to our securities (other than stock options, restricted stock units and other compensatory awards issued to such individuals by us), (3) purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities granted to them by us as part of their compensation or held, directly or indirectly, by them, (4) pledging any of our securities as collateral for any loans and (5) holding our securities in a margin account.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors has adopted corporate governance guidelines. These guidelines address, among other items, the qualifications and responsibilities of our directors and director candidates, the structure and composition of our board of directors and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer, principal accounting officer and other executive and senior financial officers. The full text of our corporate governance guidelines and code of business conduct and ethics are available on our website at https://ir.lenz-tx.com/corporate-governance/governance-documents. We will post amendments to our code of business conduct and ethics or any waivers of our code of business conduct and ethics for directors and executive officers on the same website.

Director Compensation

Director Compensation Policy

-14-

Our board of directors expects to review director compensation periodically to ensure that director compensation remains competitive such that we are able to recruit and retain qualified directors. In 2023, the compensation committee of the LENZ OpCo board of directors retained Aon, a third-party compensation consultant, to provide the LENZ OpCo board of directors and its compensation committee with an analysis of publicly available market data regarding practices and compensation levels at comparable companies and assistance in determining compensation to be provided to LENZ Therapeutics’ non-employee directors. Based on the discussions with and assistance from the compensation consultant, in connection with the Merger, our board of directors adopted an Outside Director Compensation Policy that provides for certain compensation to our non-employee directors. The Outside Director Compensation Policy became effective as of the closing of the Merger.

Cash Compensation

The Outside Director Compensation Policy provides for the following cash compensation program for our non-employee directors:

| • | $40,000 per year for service as a non-employee director; |

| • | $30,000 per year for service as non-employee chair of our board of directors; |

| • | $15,000 per year for service as chair of our audit committee; |

| • | $7,500 per year for service as a member of our audit committee; |

| • | $12,000 per year for service as chair of our compensation committee; |

| • | $6,000 per year for service as a member of our compensation committee; |

| • | $10,000 per year for service as chair of our nominating and corporate governance committee; and |

| • | $5,000 per year for service as a member of our nominating and corporate governance committee. |

Each non-employee director who serves as a committee chair of our board of directors receives the cash retainer fee as the chair of the committee but not the cash retainer fee as a member of that committee, provided that the non-employee director who serves as the non-employee chair of our board of directors receives the annual retainer fees for such role as well as the annual retainer fee for service as a non-employee director. These fees to our non-employee directors are paid quarterly in arrears on a prorated basis. The above-listed fees for service as non-employee chair of our board of directors or a chair or member of any committee are payable in addition to the non-employee director retainer. Under our Outside Director Compensation Policy, we also reimburse our non-employee directors for reasonable travel expenses to attend meetings of our board of directors and its committees.

Equity Compensation

Initial Award. Pursuant to our Outside Director Compensation Policy, each person who first becomes a non-employee director after the effective date of such policy will receive, on the first trading day on or after the date that the person first becomes a non-employee director (the first date as a non-employee director, the “Initial Start Date”), an initial award of stock options to purchase 27,000 shares of our common stock (the “Initial Award”). Each Initial Award will be scheduled to vest in equal monthly installments over thirty-six (36) months on the same day of each relevant month as the applicable vesting date, in each case subject to the outside director continuing to be an outside director through the applicable vesting date. If the person was a member of our board of directors and also an employee, then becoming a non-employee director due to termination of employment will not entitle the person to an Initial Award.

Annual Award. On the first trading day immediately following each annual meeting of the Company’s stockholders (an “Annual Meeting”) following the effective date of the Merger, each non-employee director automatically will be granted an award of stock options (an “Annual Award”) to purchase 13,500 shares of our common stock, with such number of shares subject to equitable adjustment by the Board in the event of a capitalization adjustment; provided that the first Annual Award granted to an individual who first becomes a non-employee director following the effective date of the Outside Director Compensation Policy will cover a number of shares equal to the product of (A) 13,500 multiplied by (B) a fraction, (i) the numerator of which is the number of fully completed months between the applicable Initial Start Date and the date of the first Annual Meeting to occur after such individual first becomes a non-employee director, and (ii) the denominator of which is twelve (12), subject to equitable adjustment by the Board in the event of a capitalization adjustment. Each Annual

-15-

Award will be scheduled to vest in full on the first anniversary of the date on which the Annual Award is granted, in each case subject to the non-employee director continuing to be a non-employee director through the applicable vesting date.

Other Compensation and Benefits. Non-employee directors also may be eligible to receive other compensation and benefits, as may be determined by the Board or a designated committee, as applicable, from time to time.

Change in Control. In the event of a change in control, as defined in the 2024 Equity Incentive Plan (“2024 Plan”), each non-employee director will fully vest in his or her outstanding Company equity awards as of immediately prior to a change in control, provided that the non-employee director continues to be a non-employee director through the date of the change in control.

Director Compensation Limits. Our Outside Director Compensation Policy provides that no non-employee director may be provided cash retainers or fees and granted awards with values with amounts that, in any fiscal year, in the aggregate, exceed $750,000, provided that, in the fiscal year containing a non-employee director’s Initial Start Date, such limit will be increased to $1,000,000. Any awards or other compensation provided to an individual (a) for his or her services as an employee, or for his or her services as an advisor or consultant other than as a non-employee director, or (b) prior to the closing of the Merger, will be excluded for purposes of the foregoing limit.

Director Compensation for Fiscal Year 2024

The following table sets forth information regarding the compensation earned for service on our board of directors during the year ended December 31, 2024 by non-employee directors. Mr. Schimmelpennink did not receive any additional compensation for his service as a director in 2024. Mr. Schimmelpennink’s compensation as a named executive officer, and Ms. Drapkin’s compensation received as a non-employee director since the closing of the Merger, is set forth below under “— Summary Compensation Table.”

| Name |

Fees earned or paid in cash ($) |

Option awards ($)(1) |

All other compensation ($) |

Total ($) | ||||||||||||

| Jeff George(2) |

62,418 | 333,804 | — | 396,222 | ||||||||||||

| Frederic Guerard(3) |

46,423 | 333,804 | — | 380,227 | ||||||||||||

| James McCollum(4) |

31,209 | 333,804 | — | 365,013 | ||||||||||||

| Shelley Thunen(5) |

47,593 | 333,804 | — | 381,397 | ||||||||||||

| Zach Scheiner(6) |

40,962 | 333,804 | — | 374,766 | ||||||||||||

| Abraham Bassan(7) |

11,250 | — | — | 11,250 | ||||||||||||

| Jerel Davis(7) |

11,625 | — | — | 11,625 | ||||||||||||

| Kristin M. Hege(7) |

11,250 | — | — | 11,250 | ||||||||||||

| Joseph Jimenez(7) |

11,625 | — | — | 11,625 | ||||||||||||

| Perry Karsen(7) |

19,500 | — | — | 19,500 | ||||||||||||

| Matthew Porteus(7) |

10,000 | — | 17,500 | (8) | 27,500 | |||||||||||

| Carlo Rizzuto(7) |

11,250 | — | — | 11,250 | ||||||||||||

| Smital Shah(7) |

12,500 | — | — | 12,500 | ||||||||||||

| Jo Viney(7) |

11,250 | — | — | 11,250 | ||||||||||||

| (1) | In accordance with SEC rules, this column reflects the aggregate grant date fair value of the stock option awards granted during 2024, computed in accordance with FASB ASC Topic 718, Compensation—Stock Compensation. These amounts do not reflect the actual economic value that will be realized by the director upon the vesting of the stock options, the exercise of the stock options, or the sale of the common stock underlying such stock options. |

| (2) | As of December 31, 2024, Mr. George holds outstanding options to purchase 27,000 shares. |

| (3) | As of December 31, 2024, Dr. Guerard holds outstanding options to purchase 81,468 shares. |

| (4) | As of December 31, 2024, Mr. McCollum holds outstanding options to purchase 27,000 shares. |

| (5) | As of December 31, 2024, Ms. Thunen holds outstanding options to purchase 27,000 shares. |

| (6) | As of December 31, 2024, Dr. Scheiner holds outstanding options to purchase 27,000 shares. |

| (7) | Resigned from the board of directors on March 21, 2024, effective as of the effective time of the Merger. |

| (8) | Dr. Porteus received compensation from Graphite under a consulting agreement. |

-16-

PROPOSAL NO. 1:

ELECTION OF CLASS III AND CLASS I DIRECTORS

Our board of directors currently consists of seven directors and is divided into three classes with staggered three-year terms. At the annual meeting, two Class III directors will be elected for a two year-term and two Class I directors will be elected for a three-year term, each to succeed the same class whose term is then expiring. Each director’s term continues until the expiration of the term for which such director was elected and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal.

Nominees

Our nominating and governance committee has recommended, and our board of directors has approved, Kimberlee C. Drapkin and Zach Scheiner as nominees for election as Class III directors at the annual meeting and Frederic Guerard and James McCollum as nominees as Class I directors at the annual meeting. If elected, each of Ms. Drapkin and Dr. Scheiner will serve as a Class III director until the 2027 annual meeting of stockholders and Dr. Guerard and Mr. McCollum will serve as a Class I director until the 2028 annual meeting of stockholders, each until his or her respective successor is elected and qualified or until his or her earlier death, resignation or removal. For more information concerning the nominees, please see the section titled “Board of Directors and Corporate Governance.”

Ms. Drapkin, Dr. Scheiner, Dr. Guerard, and Mr. McCollum have agreed to serve as directors if elected, and management has no reason to believe that they will be unavailable to serve. In the event a nominee is unable or declines to serve as a director at the time of the annual meeting, proxies will be voted for any nominee designated by the present board of directors to fill the vacancy.

Vote Required