EX-99.2

Published on November 15, 2023

Exhibit 99.2 + Merger Announcement November 2023

Legends Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, express or implied statements regarding the structure, timing and completion of the proposed merger by and between Graphite Bio, Inc. (“Graphite”) and LENZ Therapeutics, Inc. (“LENZ”) (the “Merger”); the combined company’s listing on Nasdaq after the closing of the proposed Merger (the “Closing”); expectations regarding the ownership structure of the combined company; the anticipated timing of the Closing; the expected executive officers and directors of the combined company; expectations regarding the structure, timing and completion of a concurrent private financing, including investment amounts from investors, timing of closing, expected proceeds and impact on ownership structure; each company’s and the combined company’s expected cash position at the Closing and cash runway of the combined company following the Merger and private financing; the future operations of the combined company, including commercialization activities, timing of launch, buildout of commercial infrastructure; the nature, strategy and focus of the combined company; the development and commercial potential and potential benefits of any product candidates of the combined company, including expectations around market exclusivity and IP protection; the location of the combined company’s corporate headquarters; anticipated clinical drug development activities and related timelines, including the expected timing for announcement of data and other clinical results and potential submission of a New Drug Application for one or more product candidates; and other statements that are not historical fact. All statements other than statements of historical fact contained in this communication are forward-looking statements. These forward-looking statements are made as of the date they were first issued, and were based on the then-current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions of management. There can be no assurance that future developments affecting Graphite, LENZ, the Merger or the concurrent private financing will be those that have been anticipated. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Graphite’s control. Graphite’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to (i) the risk that the conditions to the Closing are not satisfied, including the failure to timely obtain stockholder approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Graphite and LENZ to consummate the proposed Merger; (iii) risks related to Graphite’s ability to manage its operating expenses and its expenses associated with the proposed Merger pending the Closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed Merger; (v) the risk that as a result of adjustments to the exchange ratio, Graphite stockholders and LENZ stockholders could own more or less of the combined company than is currently anticipated; (vi) risks related to the market price of Graphite’s common stock relative to the value suggested by the exchange ratio; (vii) unexpected costs, charges or expenses resulting from the transaction; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Merger; (ix) the uncertainties associated with LENZ’s product candidates, as well as risks associated with the clinical development and regulatory approval of product candidates, including potential delays in the completion of clinical trials; (x) risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance these product candidates; (xi) uncertainties in obtaining successful clinical results for product candidates and unexpected costs that may result therefrom; (xii) risks related to the failure to realize any value from product candidates being developed and anticipated to be developed in light of inherent risks and difficulties involved in successfully bringing product candidates to market; (xiii) risks associated with the possible failure to realize certain anticipated benefits of the proposed Merger, including with respect to future financial and operating results; (xiv) the risk that the private financing is not consummated upon the Closing; and (xv) the risk that Graphite stockholders receive more or less of the cash dividend than is currently anticipated, among others. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic filings with the U.S. Securities and Exchange Commission (the “SEC”), including the factors described in the section titled “Risk Factors” in Graphite’s Annual Report on Form 10-K for the year ended December 31, 2022, as amended, filed with the SEC, subsequent Quarterly Reports on Form 10-Q filed with the SEC, and in other filings that Graphite makes and will make with the SEC in connection with the proposed Merger, including the Proxy Statement described below under “Additional Information and Where to Find It.” You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking statements. Graphite expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based. This communication does not purport to summarize all of the conditions, risks and other attributes of an investment in Graphite or LENZ. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities nor a solicitation of any vote or approval with respect to the proposed transaction or otherwise. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U S. Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Additional Information and Where to Find It This communication relates to the proposed Merger involving Graphite and LENZ and may be deemed to be solicitation material in respect of the proposed Merger. In connection with the proposed Merger, Graphite will file relevant materials with the SEC, including a registration statement on Form S-4 (the “Form S-4”) that will contain a proxy statement (the “Proxy Statement”) and prospectus. This communication is not a substitute for the Form S-4, the Proxy Statement or for any other document that Graphite may file with the SEC and or send to Graphite’s shareholders in connection with the proposed Merger. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF GRAPHITE ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GRAPHITE, THE PROPOSED MERGER AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4, the Proxy Statement and other documents filed by Graphite with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed by Graphite with the SEC will also be available free of charge on Graphite’s website at www.graphitebio.com, or by contacting Graphite’s Investor Relations at investors@graphitebio.com. Participants in the Solicitation Graphite, LENZ, and their respective directors and certain of their executive officers may be considered participants in the solicitation of proxies from Graphite’s shareholders with respect to the proposed Merger under the rules of the SEC. Information about the directors and executive officers of Graphite is set forth in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 20, 2023 and amended on April 27, 2023, subsequent Quarterly Reports on Form 10-Q and other documents that may be filed from time to time with the SEC. Additional information regarding the persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in the Form S-4, the Proxy Statement and other relevant materials to be filed with the SEC when they become available. You may 2 obtain free copies of this document as described above.

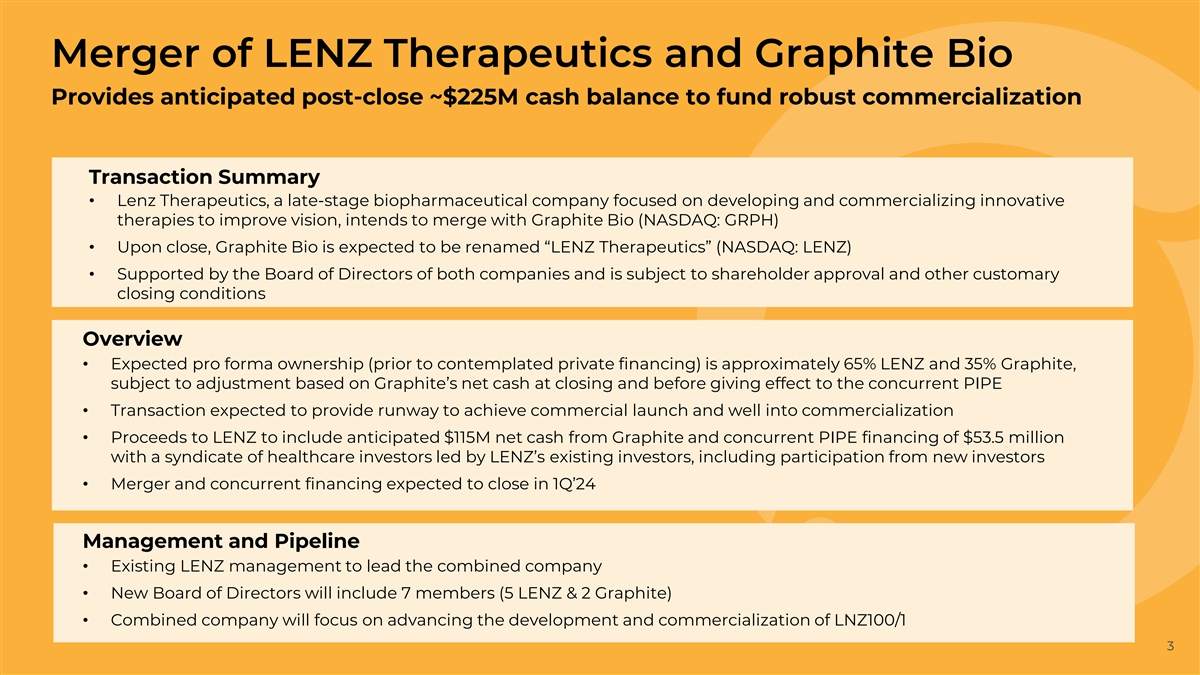

Merger of LENZ Therapeutics and Graphite Bio Provides anticipated post-close ~$225M cash balance to fund robust commercialization Transaction Summary • Lenz Therapeutics, a late-stage biopharmaceutical company focused on developing and commercializing innovative therapies to improve vision, intends to merge with Graphite Bio (NASDAQ: GRPH) • Upon close, Graphite Bio is expected to be renamed “LENZ Therapeutics” (NASDAQ: LENZ) • Supported by the Board of Directors of both companies and is subject to shareholder approval and other customary closing conditions Overview • Expected pro forma ownership (prior to contemplated private financing) is approximately 65% LENZ and 35% Graphite, subject to adjustment based on Graphite’s net cash at closing and before giving effect to the concurrent PIPE • Transaction expected to provide runway to achieve commercial launch and well into commercialization • Proceeds to LENZ to include anticipated $115M net cash from Graphite and concurrent PIPE financing of $53.5 million with a syndicate of healthcare investors led by LENZ’s existing investors, including participation from new investors • Merger and concurrent financing expected to close in 1Q’24 Management and Pipeline • Existing LENZ management to lead the combined company • New Board of Directors will include 7 members (5 LENZ & 2 Graphite) • Combined company will focus on advancing the development and commercialization of LNZ100/1 3

LENZ THERAPEUTICS – well-positioned for leadership in $3B+ presbyopia market Phase 3 ongoing for exclusive, once-daily aceclidine-based eye drop with potential of providing near vision improvement during the full work day Differentiated MOA Profile Rapid and Durable Response Only miotic shown to achieve pupil sweet LNZ100 with 73% 3-line, 92% 2-line Near Vision spot of <2mm miosis of the pupil with improvement at 30min with +10hrs duration negligible myopic shift Catalyst Rich Commercial Excellence Ph3 topline 2Q24, NDA submission mid ‘24, Critical infrastructure and leadership in place; launch upon FDA approval focused on targeting ECPs and presbyopes Market Exclusivity Financed to Commercialization Broad IP protection and potential NCE PIPE and additional cash infusion gives $ eligibility provide strong protection through sufficient runway well into commercialization at least 2039 Proven Successful Team Experienced team backed by Versant Ventures, RA Capital Management, Alpha Wave Global, Point72, Samsara BioCapital, Sectoral Asset Management and RTW Investments 4

Management and Board Management: Eef Schimmelpennink Shawn Olsson Marc Odrich, MD Marv Garrett Gerald Horn, MD Melissa Rosness Kyle Casement President and CEO Chief Commercial Officer Chief Medical Officer SVP Regulatory & Senior Scientific VP CMC & Manufacturing VP Finance Quality Advisor & Founder Board: Eef Schimmelpennink Clare Ozawa, PhD Zach Scheiner, PhD Frederic Guerard Shelley Thunen Jim McCollum Chris Dimitropoulos Stefan Larson, PhD President and CEO, Managing Director, Principal, RA Capital CEO, OPTHEA CFO, RxSight Founder Managing Director, Partner, Sectoral LENZ Versant Alpha Wave Global Asset Management Management Team Experience: 5 5

Problem Presbyopia, the inevitable loss of near vision Research shows adults over 50 lose on average 1 1.5 lines of near vision per 6 years Impacts 2 ~128M People in the US Impacts over + 120M Potential $3B Market People in the US 1. Progression of Near Vision Loss and Incidence of Near Vision Impairment in an Adult Chinese Population, Han, Xiaotong, et al, Ophthalmology, 124(5): page 734, May 2017. 6 2. Global Prevalence of Presbyopia and Vision Impairment from Uncorrected Presbyopia, Fricke, Timothy, et al, American Academy of Ophthalmology, vol 125, number 10, Oct 2018.

Solution Aceclidine Preservative free eye drop Best-in-class potential agent for presbyopia with ability to address entire patient population 7

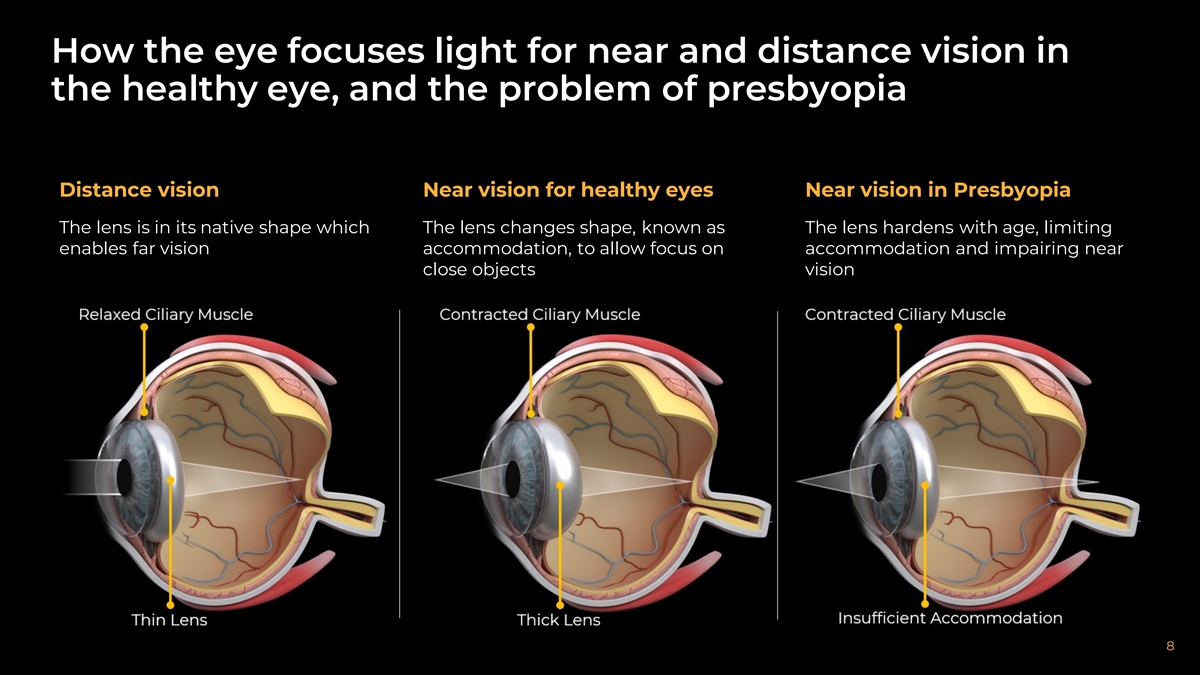

How the eye focuses light for near and distance vision in the healthy eye, and the problem of presbyopia Distance vision Near vision for healthy eyes Near vision in Presbyopia The lens is in its native shape which The lens changes shape, known as The lens hardens with age, limiting enables far vision accommodation, to allow focus on accommodation and impairing near close objects vision 8

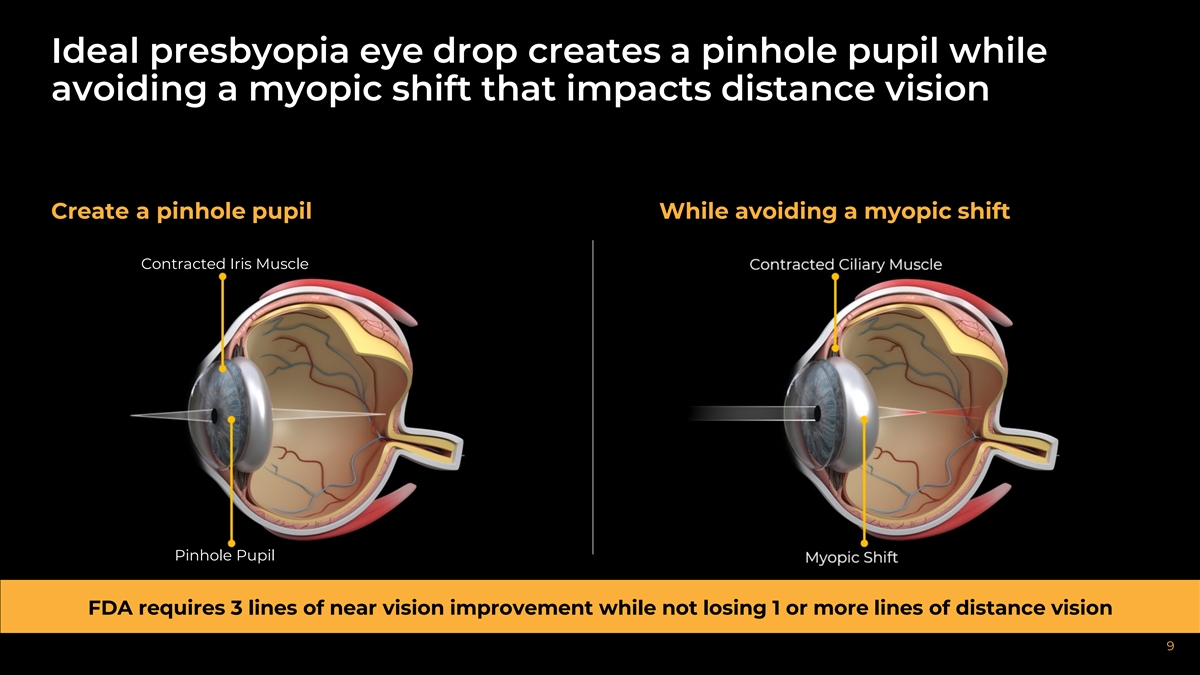

Ideal presbyopia eye drop creates a pinhole pupil while avoiding a myopic shift that impacts distance vision Create a pinhole pupil While avoiding a myopic shift Contracted Iris Muscle Pinhole Pupil FDA requires 3 lines of near vision improvement while not losing 1 or more lines of distance vision 9

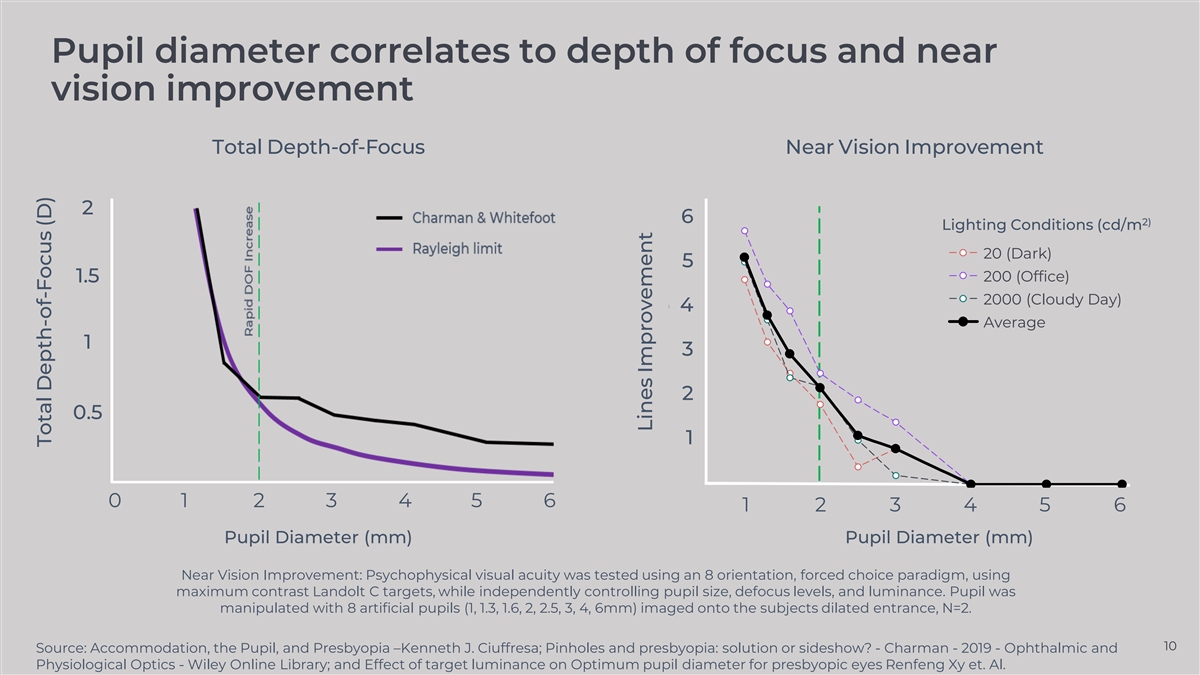

Pupil diameter correlates to depth of focus and near vision improvement Total Depth-of-Focus Near Vision Improvement 2 0.6 6 2) Lighting Conditions (cd/m 20 (Dark) 5 0.5 200 (Office) 1.5 2000 (Cloudy Day) 4 0.4 Average 1 3 0.3 2 0.2 0.5 1 0.1 0 1 2 3 4 5 6 2.0 4.0 6.0 1 2 3 4 5 6 Pupil Diameter (mm) Pupil Diameter (mm) Near Vision Improvement: Psychophysical visual acuity was tested using an 8 orientation, forced choice paradigm, using maximum contrast Landolt C targets, while independently controlling pupil size, defocus levels, and luminance. Pupil was manipulated with 8 artificial pupils (1, 1.3, 1.6, 2, 2.5, 3, 4, 6mm) imaged onto the subjects dilated entrance, N=2. 10 Source: Accommodation, the Pupil, and Presbyopia –Kenneth J. Ciuffresa; Pinholes and presbyopia: solution or sideshow? - Charman - 2019 - Ophthalmic and Physiological Optics - Wiley Online Library; and Effect of target luminance on Optimum pupil diameter for presbyopic eyes Renfeng Xy et. Al. Total Depth-of-Focus (D) Lines Improvement

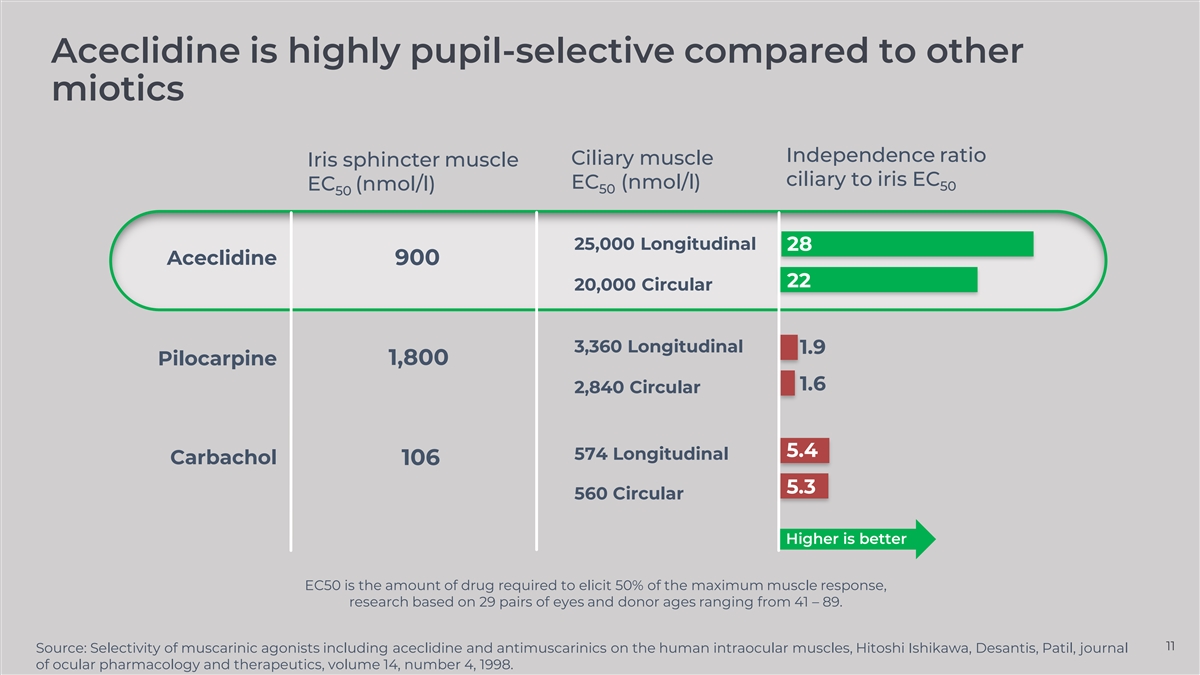

Aceclidine is highly pupil-selective compared to other miotics Independence ratio Ciliary muscle Iris sphincter muscle ciliary to iris EC EC (nmol/l) EC (nmol/l) 50 50 50 25,000 Longitudinal 28 Aceclidine 900 22 20,000 Circular 3,360 Longitudinal 1.9 Pilocarpine 1,800 1.6 2,840 Circular 5.4 574 Longitudinal Carbachol 106 5.3 560 Circular Higher is better EC50 is the amount of drug required to elicit 50% of the maximum muscle response, research based on 29 pairs of eyes and donor ages ranging from 41 – 89. 11 Source: Selectivity of muscarinic agonists including aceclidine and antimuscarinics on the human intraocular muscles, Hitoshi Ishikawa, Desantis, Patil, journal of ocular pharmacology and therapeutics, volume 14, number 4, 1998.

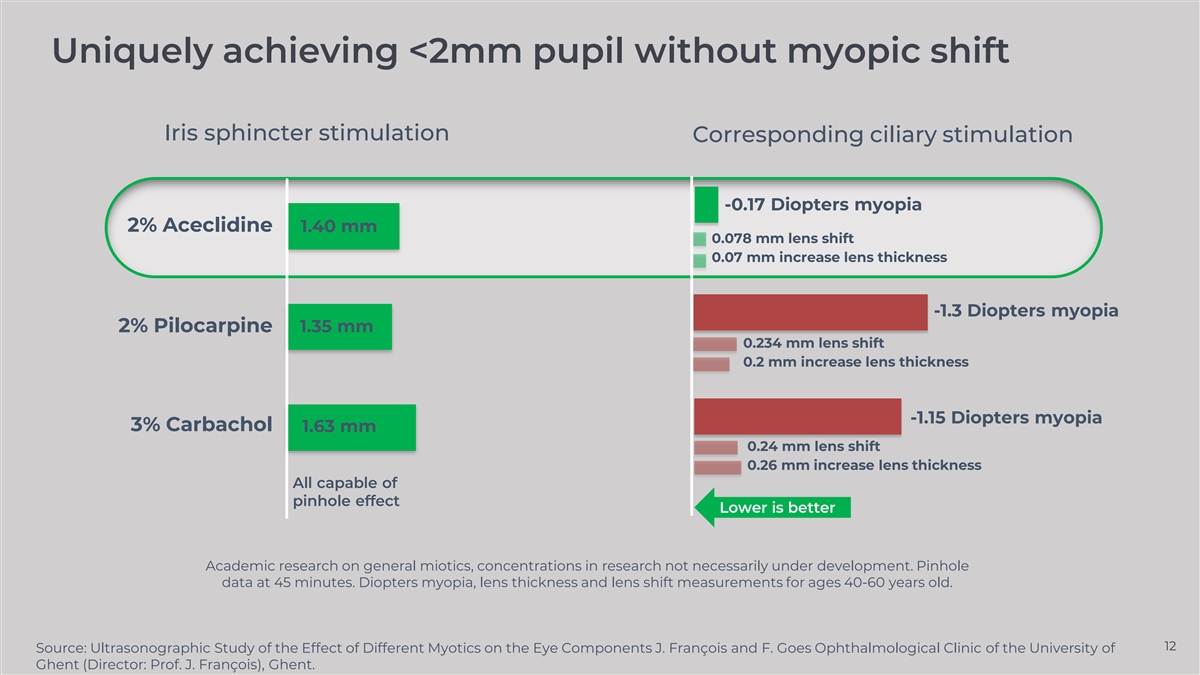

Uniquely achieving <2mm pupil without myopic shift Iris sphincter stimulation Corresponding ciliary stimulation -0.17 Diopters myopia 2% Aceclidine 1.40 mm 0.078 mm lens shift 0.07 mm increase lens thickness -1.3 Diopters myopia 2% Pilocarpine 1.35 mm 0.234 mm lens shift 0.2 mm increase lens thickness -1.15 Diopters myopia 3% Carbachol 1.63 mm 0.24 mm lens shift 0.26 mm increase lens thickness All capable of pinhole effect Lower is better Academic research on general miotics, concentrations in research not necessarily under development. Pinhole data at 45 minutes. Diopters myopia, lens thickness and lens shift measurements for ages 40-60 years old. 12 Source: Ultrasonographic Study of the Effect of Different Myotics on the Eye Components J. François and F. Goes Ophthalmological Clinic of the University of Ghent (Director: Prof. J. François), Ghent.

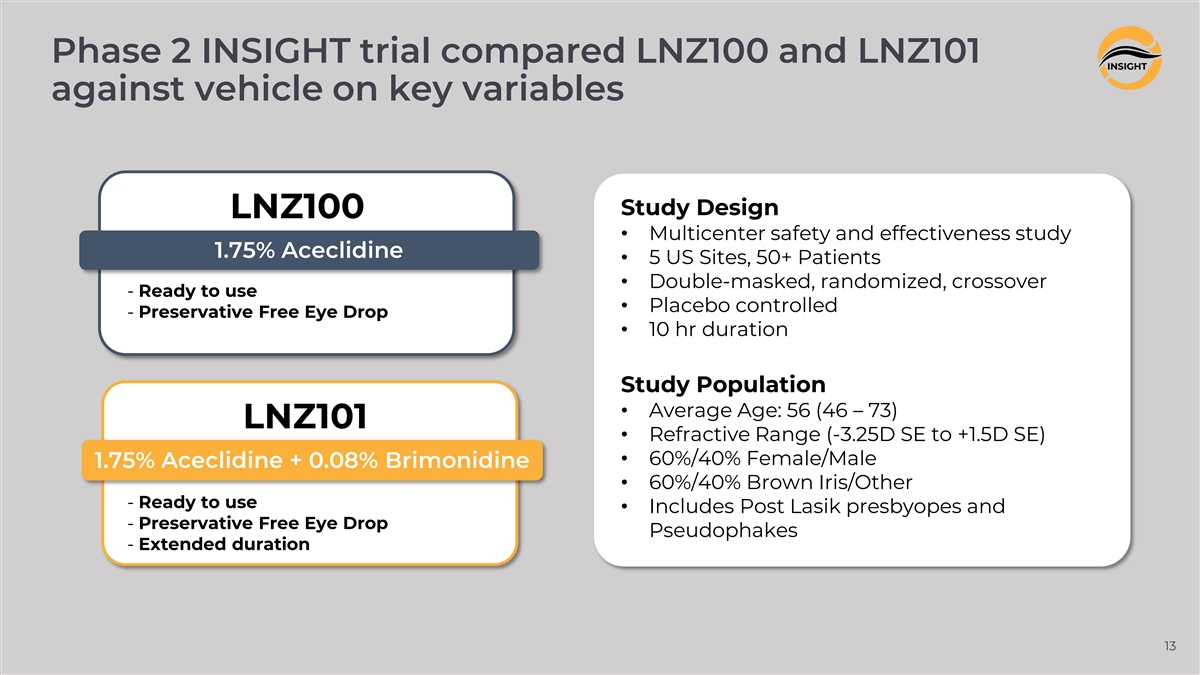

Phase 2 INSIGHT trial compared LNZ100 and LNZ101 against vehicle on key variables Study Design LNZ100 • Multicenter safety and effectiveness study 1.75% Aceclidine • 5 US Sites, 50+ Patients • Double-masked, randomized, crossover - Ready to use • Placebo controlled - Preservative Free Eye Drop • 10 hr duration Study Population • Average Age: 56 (46 – 73) LNZ101 • Refractive Range (-3.25D SE to +1.5D SE) • 60%/40% Female/Male 1.75% Aceclidine + 0.08% Brimonidine • 60%/40% Brown Iris/Other - Ready to use • Includes Post Lasik presbyopes and - Preservative Free Eye Drop Pseudophakes - Extended duration 13

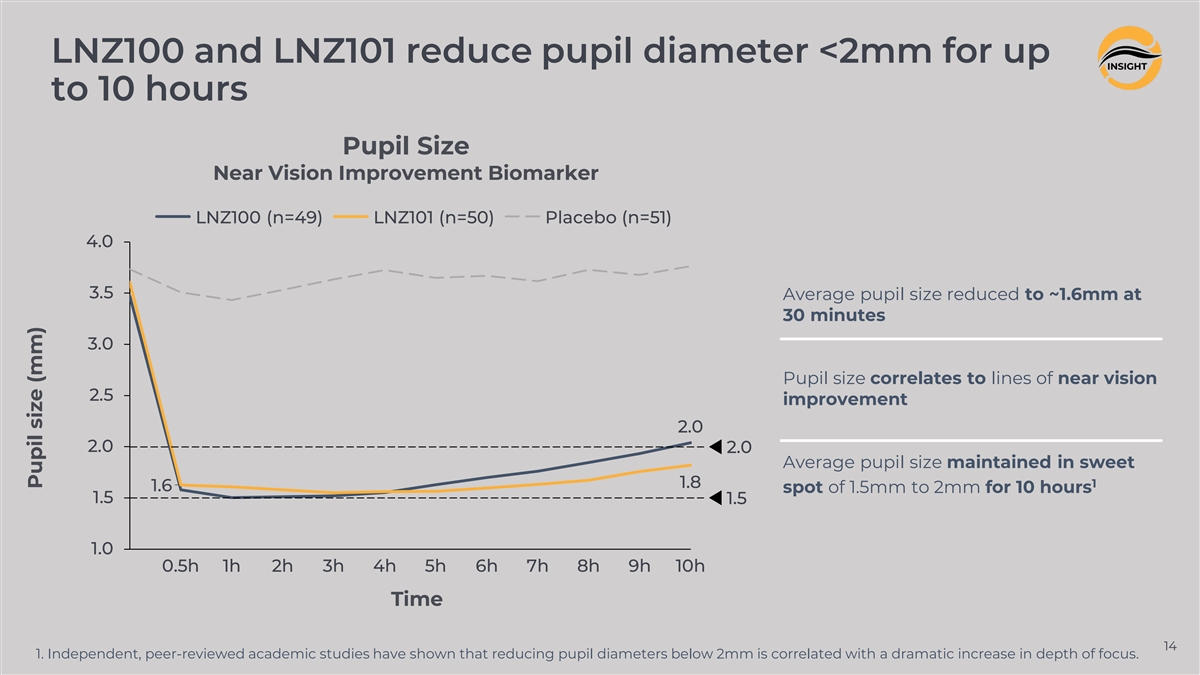

LNZ100 and LNZ101 reduce pupil diameter <2mm for up to 10 hours Pupil Size Near Vision Improvement Biomarker LNZ100 (n=49) LNZ101 (n=50) Placebo (n=51) 4.0 3.5 Average pupil size reduced to ~1.6mm at 30 minutes 3.0 Pupil size correlates to lines of near vision 2.5 improvement 2.0 2.0 2.0 Average pupil size maintained in sweet 1 1.8 1.6 spot of 1.5mm to 2mm for 10 hours 1.5 1.5 1.0 0.5h 1h 2h 3h 4h 5h 6h 7h 8h 9h 10h Time 14 1. Independent, peer-reviewed academic studies have shown that reducing pupil diameters below 2mm is correlated with a dramatic increase in depth of focus. Pupil size (mm)

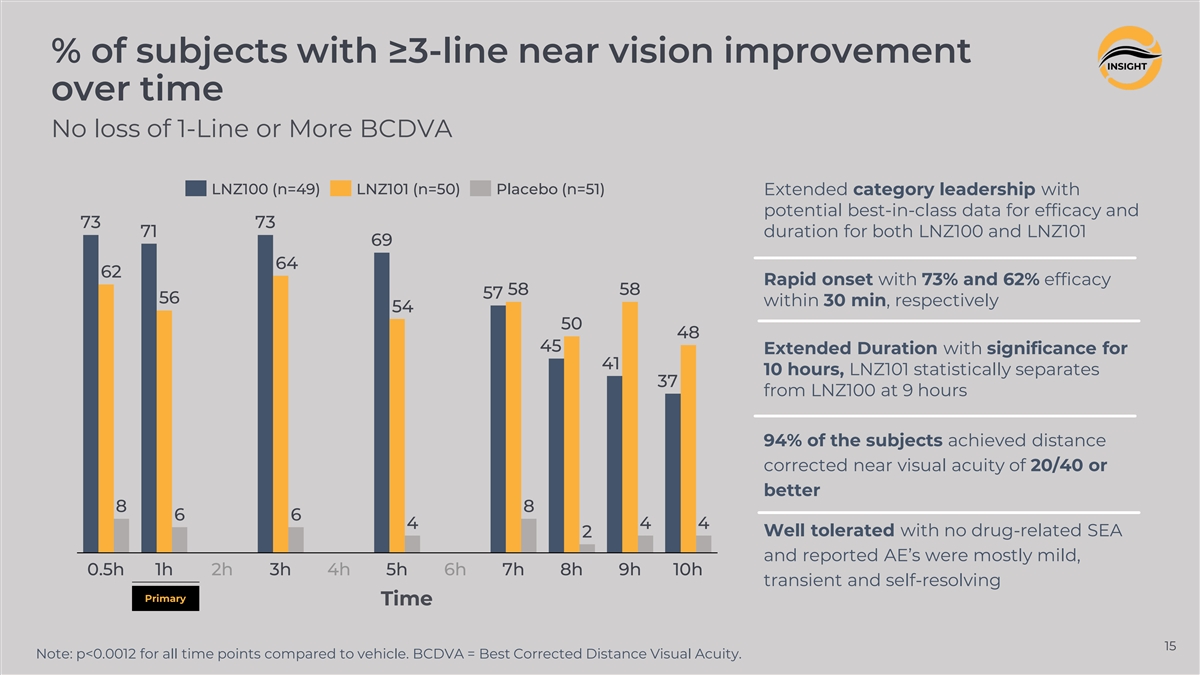

% of subjects with ≥3-line near vision improvement over time No loss of 1-Line or More BCDVA LNZ100 (n=49) LNZ101 (n=50) Placebo (n=51) Extended category leadership with potential best-in-class data for efficacy and 73 73 71 duration for both LNZ100 and LNZ101 69 64 62 Rapid onset with 73% and 62% efficacy 58 58 57 56 within 30 min, respectively 54 50 48 45 Extended Duration with significance for 41 10 hours, LNZ101 statistically separates 37 from LNZ100 at 9 hours 94% of the subjects achieved distance corrected near visual acuity of 20/40 or better 8 8 6 6 4 4 4 Well tolerated with no drug-related SEA 2 and reported AE’s were mostly mild, 0.5h 1h 2h 3h 4h 5h 6h 7h 8h 9h 10h transient and self-resolving Primary Time 15 Note: p<0.0012 for all time points compared to vehicle. BCDVA = Best Corrected Distance Visual Acuity.

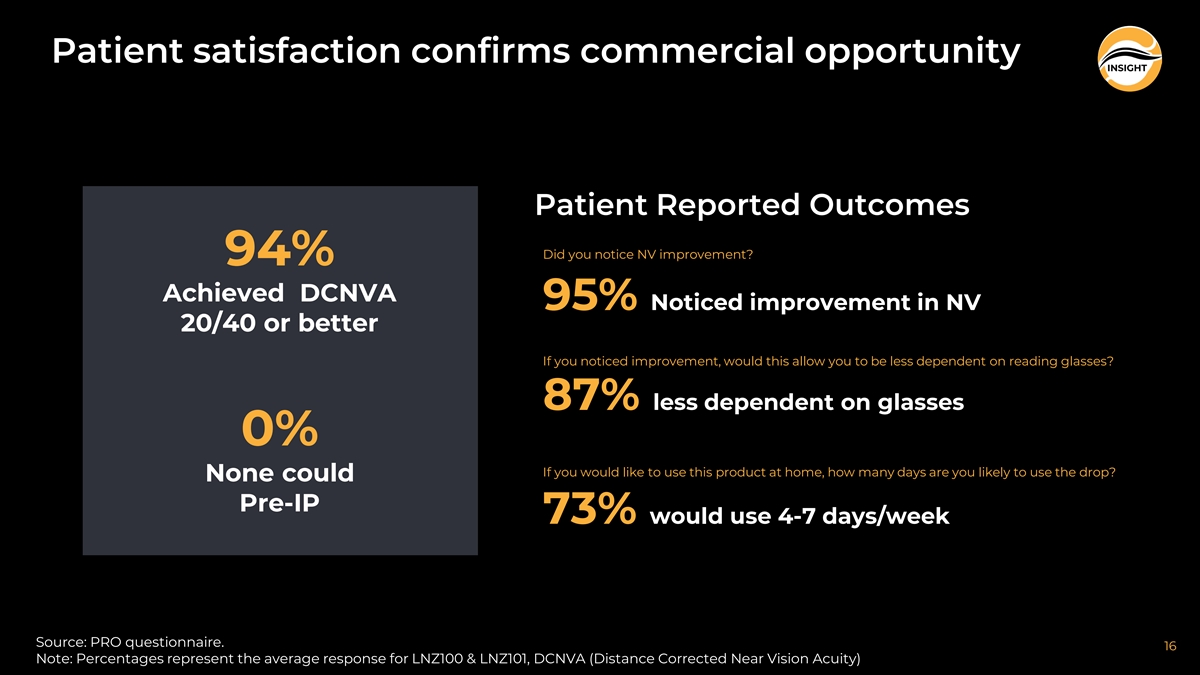

Patient satisfaction confirms commercial opportunity Patient Reported Outcomes Did you notice NV improvement? 94% Achieved DCNVA 95% Noticed improvement in NV 20/40 or better If you noticed improvement, would this allow you to be less dependent on reading glasses? 87% less dependent on glasses 0% If you would like to use this product at home, how many days are you likely to use the drop? None could Pre-IP 73% would use 4-7 days/week Source: PRO questionnaire. 16 Note: Percentages represent the average response for LNZ100 & LNZ101, DCNVA (Distance Corrected Near Vision Acuity)

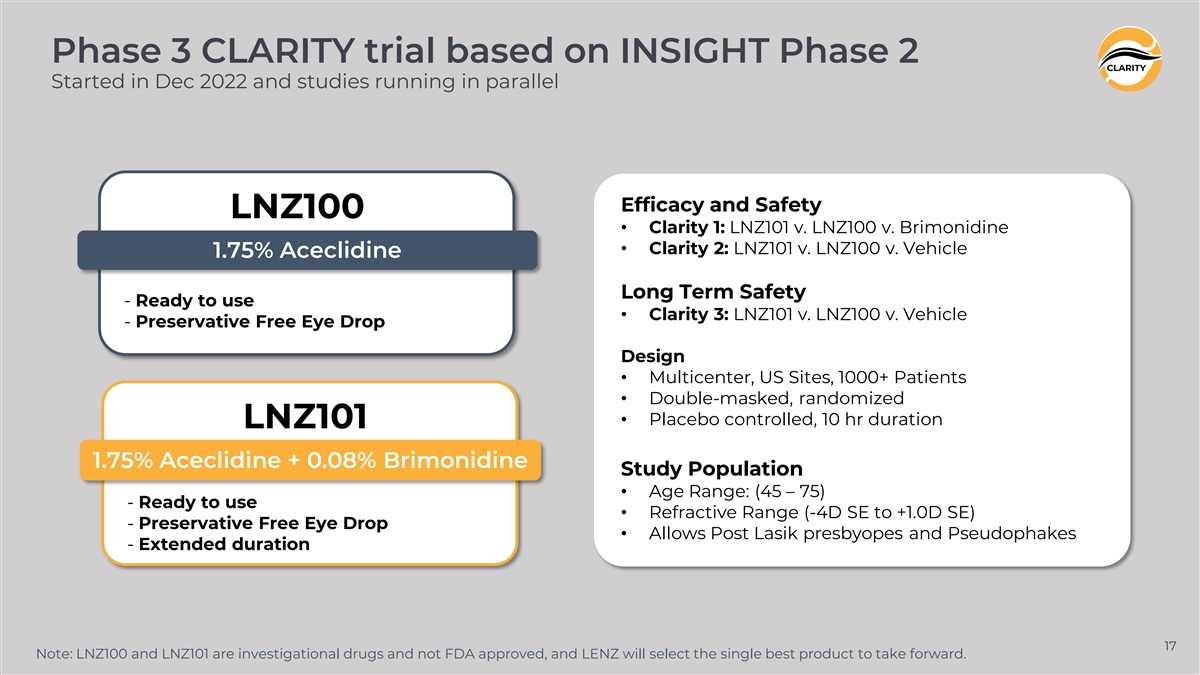

Phase 3 CLARITY trial based on INSIGHT Phase 2 CLARITY Started in Dec 2022 and studies running in parallel Efficacy and Safety LNZ100 • Clarity 1: LNZ101 v. LNZ100 v. Brimonidine • Clarity 2: LNZ101 v. LNZ100 v. Vehicle 1.75% Aceclidine Long Term Safety - Ready to use • Clarity 3: LNZ101 v. LNZ100 v. Vehicle - Preservative Free Eye Drop Design • Multicenter, US Sites, 1000+ Patients • Double-masked, randomized • Placebo controlled, 10 hr duration LNZ101 1.75% Aceclidine + 0.08% Brimonidine Study Population • Age Range: (45 – 75) - Ready to use • Refractive Range (-4D SE to +1.0D SE) - Preservative Free Eye Drop • Allows Post Lasik presbyopes and Pseudophakes - Extended duration 17 Note: LNZ100 and LNZ101 are investigational drugs and not FDA approved, and LENZ will select the single best product to take forward.

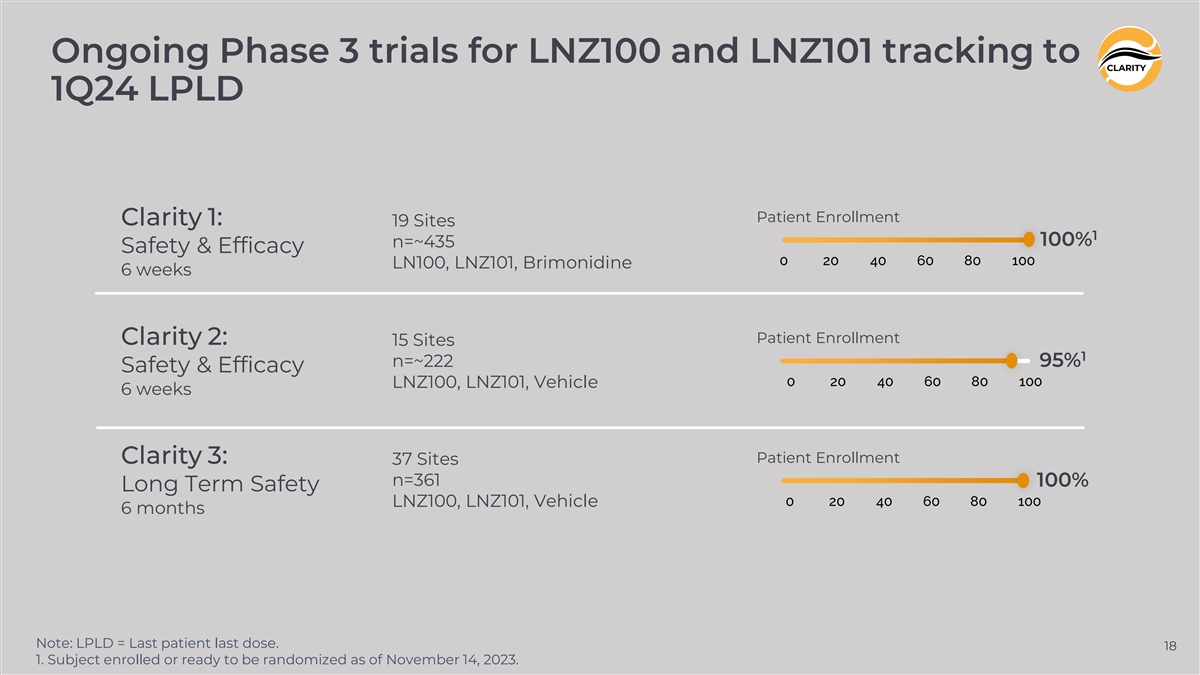

Ongoing Phase 3 trials for LNZ100 and LNZ101 tracking to CLARITY 1Q24 LPLD Patient Enrollment Clarity 1: 19 Sites 1 100% n=~435 Safety & Efficacy 0 20 40 60 80 100 LN100, LNZ101, Brimonidine 6 weeks Patient Enrollment Clarity 2: 15 Sites 1 n=~222 95% Safety & Efficacy 0 20 40 60 80 100 LNZ100, LNZ101, Vehicle 6 weeks Patient Enrollment Clarity 3: 37 Sites n=361 100% Long Term Safety 0 20 40 60 80 100 LNZ100, LNZ101, Vehicle 6 months Note: LPLD = Last patient last dose. 18 1. Subject enrolled or ready to be randomized as of November 14, 2023.

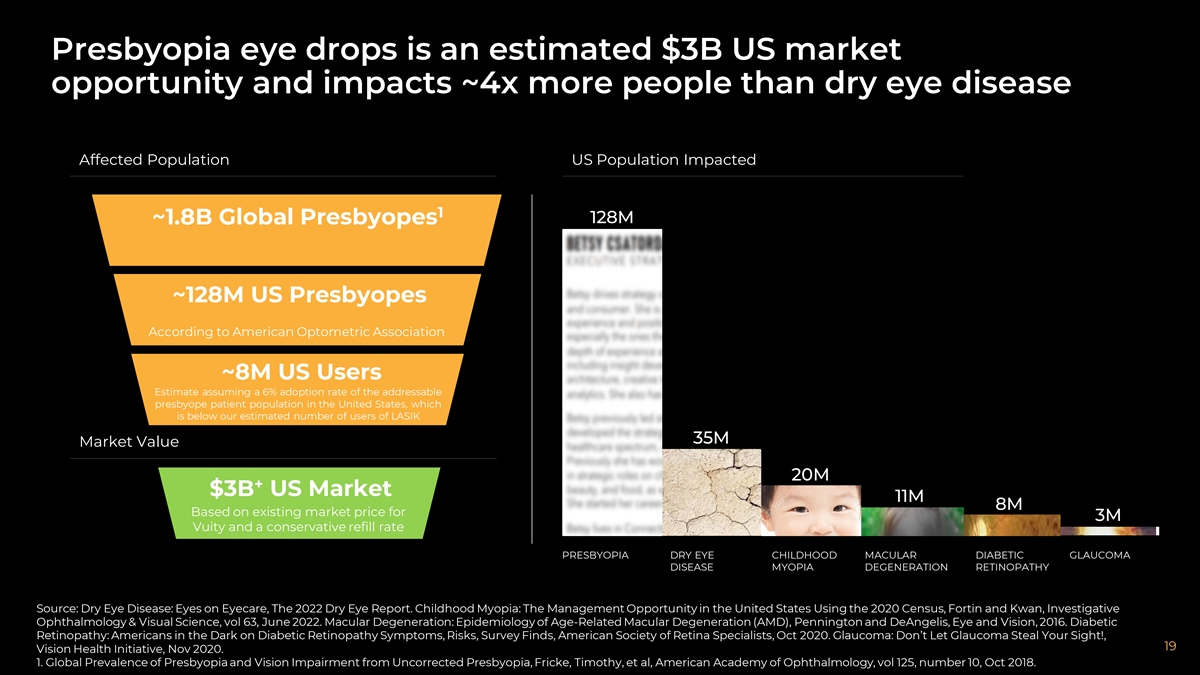

Presbyopia eye drops is an estimated $3B US market opportunity and impacts ~4x more people than dry eye disease Affected Population US Population Impacted 1 128M ~1.8B Global Presbyopes ~128M US Presbyopes According to American Optometric Association ~8M US Users Estimate assuming a 6% adoption rate of the addressable presbyope patient population in the United States, which is below our estimated number of users of LASIK 35M Market Value 20M + $3B US Market 11M 8M Based on existing market price for 3M Vuity and a conservative refill rate PRESBYOPIA DRY EYE CHILDHOOD MACULAR DIABETIC GLAUCOMA DISEASE MYOPIA DEGENERATION RETINOPATHY Source: Dry Eye Disease: Eyes on Eyecare, The 2022 Dry Eye Report. Childhood Myopia: The Management Opportunity in the United States Using the 2020 Census, Fortin and Kwan, Investigative Ophthalmology & Visual Science, vol 63, June 2022. Macular Degeneration: Epidemiology of Age-Related Macular Degeneration (AMD), Pennington and DeAngelis, Eye and Vision, 2016. Diabetic Retinopathy: Americans in the Dark on Diabetic Retinopathy Symptoms, Risks, Survey Finds, American Society of Retina Specialists, Oct 2020. Glaucoma: Don’t Let Glaucoma Steal Your Sight!, 19 Vision Health Initiative, Nov 2020. 1. Global Prevalence of Presbyopia and Vision Impairment from Uncorrected Presbyopia, Fricke, Timothy, et al, American Academy of Ophthalmology, vol 125, number 10, Oct 2018.

LENZ has the potential to deliver on a significant unmet need Broad Patient Population Proven to work for most presbyopes and in broad range of ages and refractive errors Highly Significant Response Rates LNZ100 with 73% 3-line, 92% 2-line NV improvement at 30 min with +10hrs duration ECP and Consumer loyalty Commercial strategy aimed at building a brand with emotional connection and value 20 20

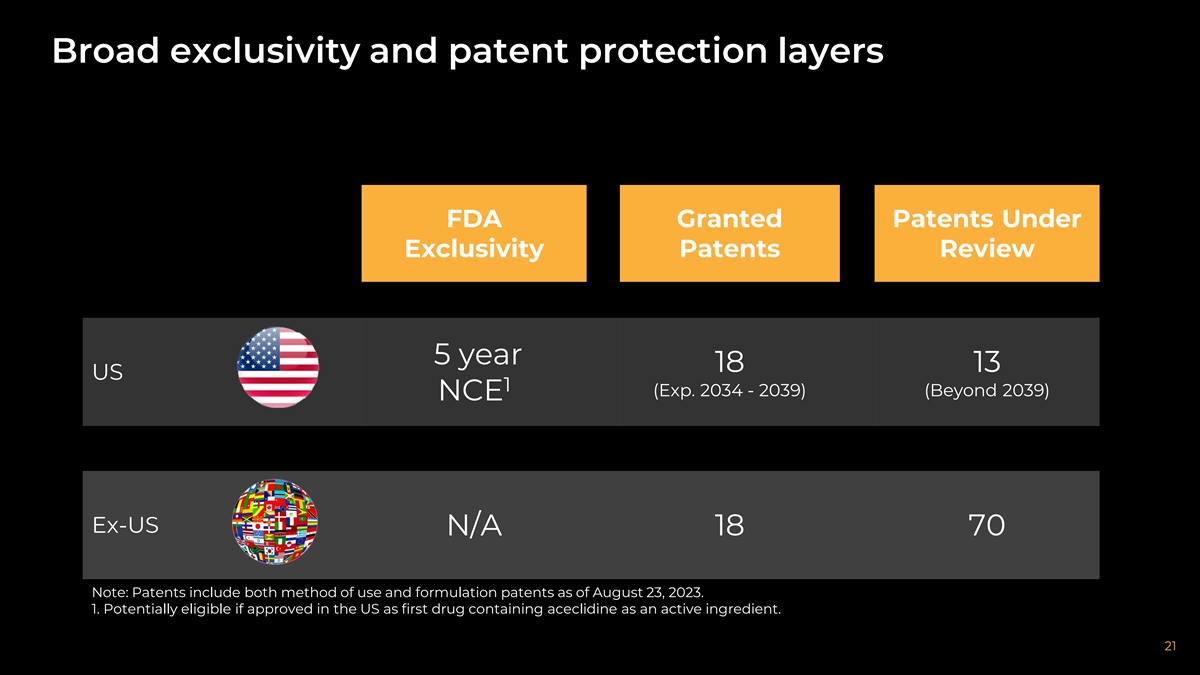

Broad exclusivity and patent protection layers FDA Granted Patents Under Exclusivity Patents Review 5 year 18 13 US 1 (Exp. 2034 - 2039) (Beyond 2039) NCE Ex-US N/A 18 70 Note: Patents include both method of use and formulation patents as of August 23, 2023. 1. Potentially eligible if approved in the US as first drug containing aceclidine as an active ingredient. 21

Global Strategy High Ex-US interest in licensing deals Greater China Licensing Agreement in place - One of largest China Phase 2 ophthalmology deals - $15M Upfront, $15M Development milestone, $80M in Sales milestones - Royalty rates between 5 – 15% - CTA (Clinical Trial Application) approved by NMPA 22

LENZ Therapeutics Well-positioned for potential leadership in $3B+ market Phase 3 ongoing for exclusive, once-daily aceclidine-based eye drop with potential of providing near vision improvement during the full work day Differentiated MOA Profile Rapid and Durable Response Only miotic shown to achieve pupil sweet LNZ100 with 73% 3-line, 92% 2-line Near Vision spot of <2mm miosis of the pupil with improvement at 30min with +10hrs duration negligible myopic shift Catalyst Rich Commercial Excellence Ph3 topline 2Q24, NDA submission mid ‘24, Critical infrastructure and leadership in place; US launch mid ‘25 focused on targeting ECPs and presbyopes Market Exclusivity Financed to Commercialization Broad IP protection and potential NCE PIPE and additional cash infusion gives $ eligibility provide strong protection through sufficient runway well into commercialization at least 2039 Proven Successful Team Experienced team backed by Versant Ventures, RA Capital Management, Alpha Wave Global, Point72, Samsara BioCapital, Sectoral Asset Management and RTW Investments 23